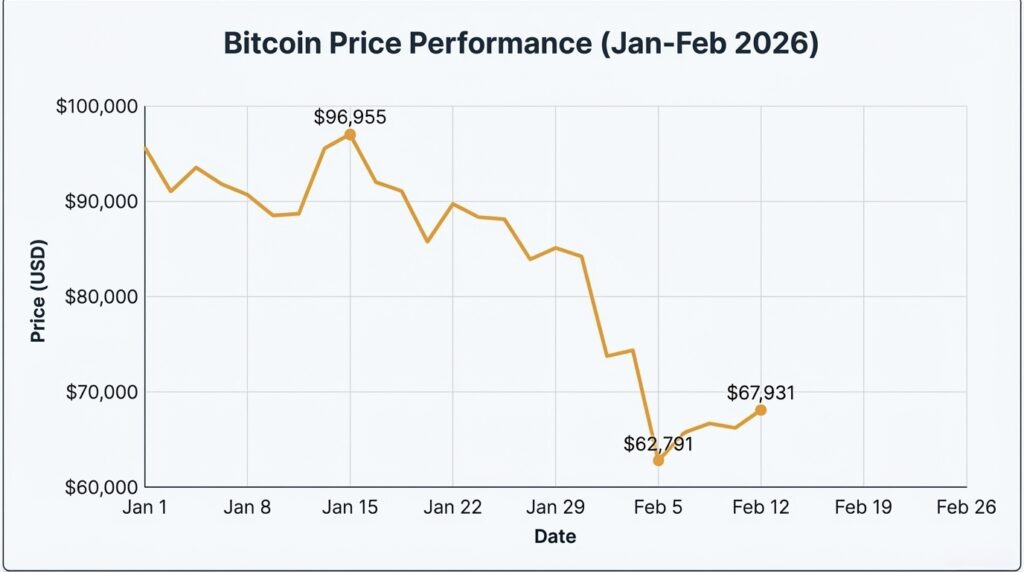

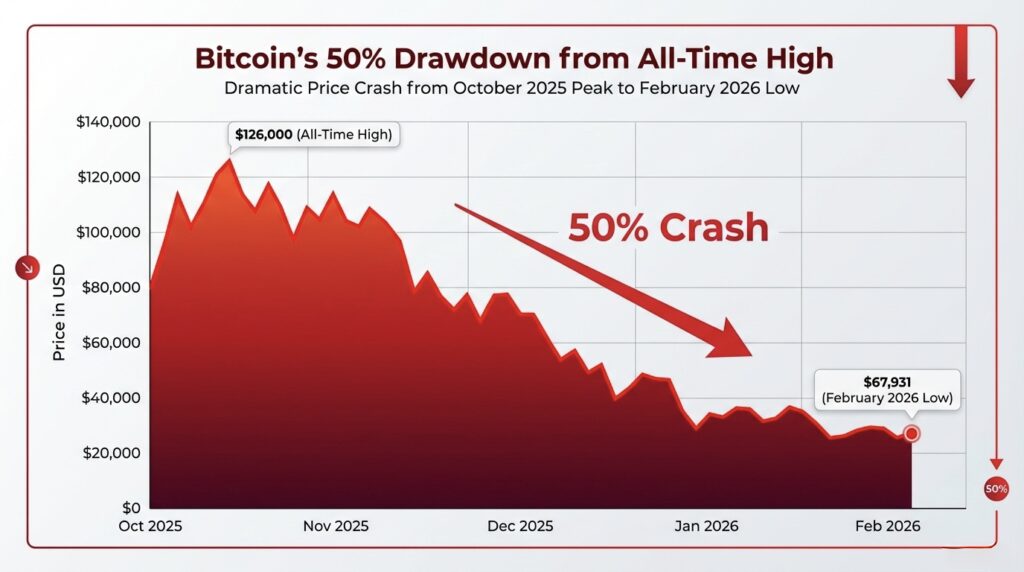

February 12, 2026 — Bitcoin is trading around $67,930 as of today, showing remarkable resilience despite extreme market fear and institutional downgrades that have shaken investor confidence throughout February. The world’s leading cryptocurrency has experienced a brutal 50% drawdown from its late-2025 all-time high of $126,000, yet analysts remain divided on whether the worst is behind us or if more pain lies ahead.

Current Market Snapshot: BTC Holds Ground Despite Fear

After a volatile trading session, Bitcoin managed to climb above $67,000, posting a modest 1.34% gain despite a stronger-than-expected U.S. jobs report that pushed back Federal Reserve rate cut expectations to July. The cryptocurrency briefly touched $68,375 before consolidating, demonstrating what some analysts are calling “seller exhaustion” in a market gripped by panic.

Bitcoin defied the hot jobs report, showing signs of resilience even as the Crypto Fear & Greed Index plummeted to just 5—its lowest level since the FTX collapse in 2022, signaling “extreme fear” across the market.

The 50% Crash: From $126K to $67K

Bitcoin‘s decline from its October 2025 peak of $126,000 to current levels represents a 50% drawdown, marking one of the most significant corrections in the current cycle. According to CNBC’s analysis, historical patterns suggest Bitcoin typically falls about 75% during each four-year cycle, indicating the token may have further to decline in the near term.

The selloff has been particularly brutal in February, with Bitcoin hitting a local bottom of $60,001 on February 6 before staging a modest recovery. Trading volume has surged to over $114 billion during the most volatile days, reflecting intense market participation and liquidation cascades.

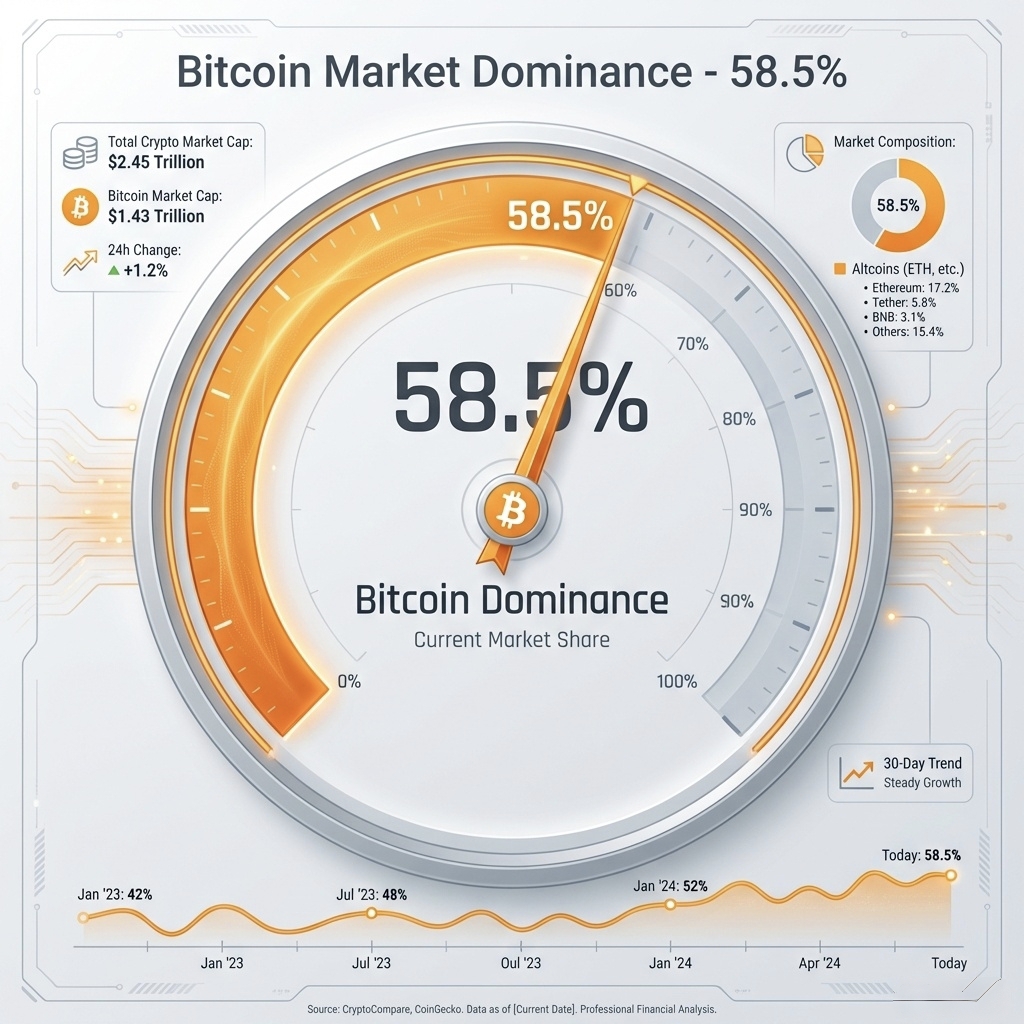

BTC Dominance: A Silver Lining at 58.5%

While Bitcoin’s price has suffered, its market dominance tells a more encouraging story. BTC dominance currently sits at approximately 58.5%, according to CoinMarketCap data, indicating that Bitcoin continues to capture the lion’s share of crypto market capitalization.

This relatively high dominance level suggests investors are seeking refuge in the sector’s most established asset during periods of uncertainty. Bitcoin dominance above 55% typically signals that capital is consolidating into BTC rather than flowing into riskier altcoins—a pattern often observed during market corrections when investors prioritize relative safety over speculative gains.

Current Market Breakdown:

- Bitcoin (BTC): 58.5% dominance

- Ethereum (ETH): 10.3%

- Stablecoins: 10.3%

- Other Altcoins: 20.9%

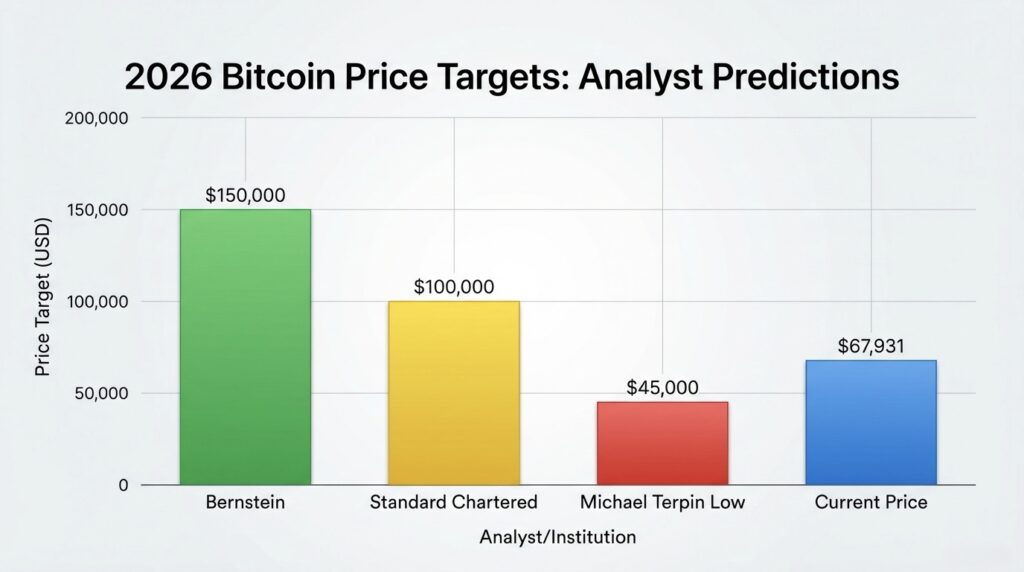

Wall Street Divided: Bernstein vs. Standard Chartered

The analyst community remains sharply divided on Bitcoin’s trajectory for 2026, with major institutions taking starkly different positions:

Bernstein: “Weakest Bear Case in History” – $150,000 Target

Research firm Bernstein has doubled down on its bullish stance, calling the current selloff the “weakest Bitcoin bear case in history” and maintaining its $150,000 price target for end-of-2026.

Analysts led by Gautam Chhugani argued in a Monday note:

“What we are experiencing is the weakest bitcoin bear case in its history. Nothing blew up, no skeletons will unravel. When all stars are aligned, [the] Bitcoin community manufactures a self-imposed crisis of confidence.”

The firm highlighted that unlike previous crypto winters triggered by major failures, hidden leverage, or systemic breakdowns—such as Mt. Gox, Terra/LUNA, or FTX—this cycle shows no comparable catastrophes. Instead, they point to:

- Robust institutional infrastructure

- Pro-crypto U.S. political environment

- Expanding spot ETF adoption

- Growing corporate treasury participation

Bernstein dismissed quantum computing fears and concerns about AI rendering Bitcoin irrelevant, arguing that blockchains will play a central role in an emerging “agentic” digital environment where autonomous software agents require global, machine-readable financial rails.

Standard Chartered: Slashes Target to $100,000, Warns of $50,000

In stark contrast, Standard Chartered has cut its Bitcoin forecast for the second time in three months, now projecting Bitcoin to end 2026 at $100,000—down from a prior $150,000 target and a much more optimistic $300,000 forecast made in December.

The bank warned that Bitcoin could slide to $50,000 before recovering, representing another 26% drop from current levels. This bearish revision reflects concerns about:

- Tighter monetary policy and delayed Fed rate cuts

- Reduced liquidity in crypto markets

- Weakening institutional demand

- Prolonged accumulation phase

Crypto Twitter Sentiment: Caution Prevails

Prominent crypto analysts on X (formerly Twitter) are expressing measured caution about the near-term outlook:

PlanB (@100trillionUSD), creator of the Stock-to-Flow model, tweeted:

“Happy 2026!! Down -6% from $93,381 end 2024. IMO bitcoin is extremely undervalued. Bitcoin is scarcer than gold and real estate, but valued 10x to 100x lower.”

Michael Terpin, CEO of Transform Ventures, warned that Bitcoin could see “one more point of pain”, potentially revisiting the $50,000s or even $40,000s before establishing a true bottom. Terpin argued that Bitcoin’s post-halving bubble followed its typical arc, and historical patterns suggest the market may face another wave of selling pressure.

Technical Analysis: Key Levels to Watch

From a technical perspective, Bitcoin faces critical resistance and support zones:

Resistance Levels:

- $70,000-$71,000: Psychological barrier and recent rejection zone

- $75,000: Major resistance; breaking above could signal trend reversal

- $80,000: Critical level for bulls to reclaim bullish momentum

Support Levels:

- $66,000: Immediate support with liquidation cluster

- $60,000: Strong psychological support tested on Feb 6

- $50,000-$52,000: Analysts’ projected bottom range

Technical Indicators:

- Perpetual Funding Rates: Neutral to slightly positive on major exchanges (Binance +3.4%, Bybit +9.5%)

- Open Interest: Holding steady near $15.8 billion

- Options Market: 25-delta skew at 19%, with puts comprising 54% of 24-hour volume

- Implied Volatility: Short-term backwardation reflecting “panic premium”

Market Sentiment: Extreme Fear Dominates

The Crypto Fear & Greed Index currently stands at 5 out of 100, representing “extreme fear”—the lowest reading since the FTX collapse in November 2022. Historically, such extreme fear levels have marked capitulation bottoms, though timing the exact bottom remains notoriously difficult.

Despite the bearish sentiment, derivatives positioning shows signs of stabilization:

- 24-hour liquidations: $342 million ($145M in BTC, $84M in ETH)

- Long/Short split: Relatively balanced at 49-51%

- Funding rates: Returning to neutral/positive territory after sustained negativity

Institutional Developments: BlackRock and Uniswap

In positive news, BlackRock announced it is bringing its $2.2 billion tokenized U.S. Treasury fund (BUIDL) to Uniswap, marking the first time the world’s largest asset manager has listed a tokenized product on a decentralized exchange. BlackRock also took a strategic investment in Uniswap and purchased an undisclosed amount of UNI governance tokens.

This development underscores continued institutional interest in crypto infrastructure despite market volatility, suggesting long-term conviction remains intact among major players.

What’s Next for Bitcoin?

The cryptocurrency market finds itself at a critical juncture. Bulls point to:

✅ Strong institutional infrastructure (ETF inflows, corporate treasuries)

✅ Pro-crypto regulatory environment in the U.S.

✅ High Bitcoin dominance showing “flight to safety” within crypto

✅ Extreme fear levels historically marking capitulation bottoms

✅ No systemic failures or major exchange collapses

Bears highlight:

⚠️ Delayed Fed rate cuts due to stronger-than-expected employment

⚠️ Historical patterns suggesting 75% drawdowns are typical

⚠️ Reduced market liquidity and sideways consolidation expected until summer

⚠️ Potential for one more leg down to $40K-$50K range

⚠️ Rising stablecoin dominance (10.3%) suggesting risk-off behavior

Analyst Consensus: $40K-$150K Range for 2026

Price targets for year-end 2026 vary dramatically:

- Most Bullish: Bernstein at $150,000

- Moderately Bullish: Standard Chartered at $100,000

- Neutral/Cautious: Various analysts $75,000-$90,000

- Bearish Scenario: Michael Terpin $40,000-$50,000 before recovery

Multiple analysts, including those at Investing.com, suggest Bitcoin could remain range-bound until summer 2026 as the market enters a prolonged accumulation phase following its sharp correction from late-2025 highs.

Conclusion: Patience Required in Volatile Waters

Bitcoin’s journey through 2026 reflects the cryptocurrency’s continued maturation as an asset class—experiencing traditional market cycles with corrections, consolidation, and eventual recovery. While short-term pain may persist, the absence of systemic failures and continued institutional adoption suggest the long-term bull case remains intact.

For investors, the current environment demands patience, disciplined risk management, and a long-term perspective. Whether Bitcoin reaches $150,000 or revisits $50,000 first remains to be seen, but one thing is certain: volatility will continue to define the crypto market in the months ahead.

Current Price: $67,930 | 24h Change: +1.34% | BTC Dominance: 58.5%

Fear & Greed Index: 5 (Extreme Fear)

All Images Generated Genspark

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risk. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

Join our Telegram Channel

Join our Telegram Channel