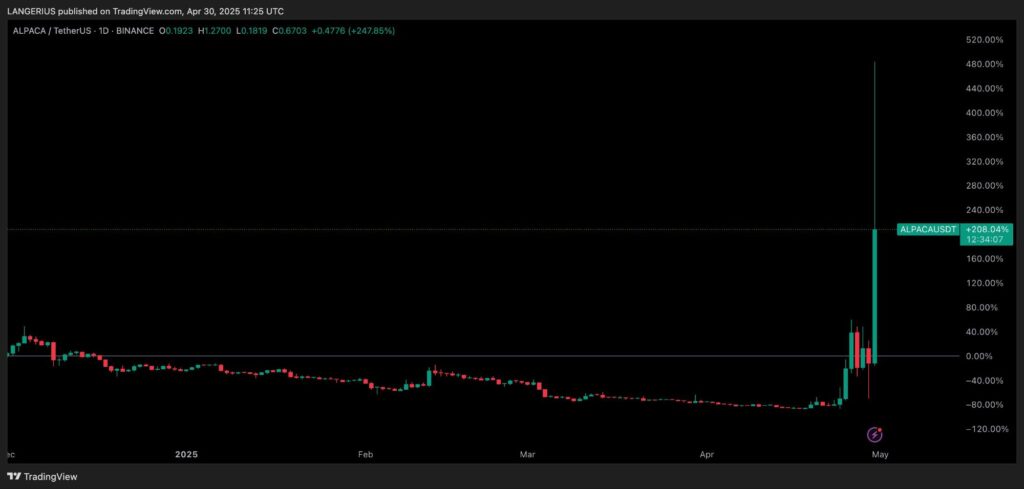

The ALPACA token, tied to the decentralized finance protocol Alpaca Finance, soared over 1,000% after Binance announced its delisting on April 24, 2025, defying expectations of a price drop. The token peaked at $1.47 from a low of $0.066 before falling to $0.53-$0.61 by May 2, fueling allegations of market manipulation by large traders. This volatility highlights ongoing challenges in regulating low-cap cryptocurrencies.

Binance’s delisting, effective May 2, 2025, cited ALPACA’s low trading volume and developer inactivity as reasons for removal, alongside three other tokens. Typically, such news triggers panic selling, but ALPACA’s price action was extraordinary. Trading volume surged to $3 billion in 24 hours, with $52 million in short liquidations, indicating a short squeeze where traders betting on a decline were forced to buy at higher prices.

Crypto analysts described the movement as a potential “liquidity hunt,” where large traders, or whales, crash prices to induce panic, then pump them to liquidate short positions. Social media discussions on X called it “peak price manipulation,” with some users pointing to unusual trading volume before the announcement as evidence of insider activity. Speculation about groups like 48CLUB, a Binance Smart Chain operator, surfaced, though no evidence supports these claims.

On April 25, 2025, Alpaca Finance canceled a planned token issuance for a market maker, citing community backlash. This tightened supply, potentially contributing to the rally. However, the surge’s scale—1,800% at its peak—suggests coordinated tactics beyond organic demand.

The market reaction was dramatic. ALPACA’s futures open interest reached $110 million, rivaling major tokens, before the price dropped 30-60% on April 30. Binance’s adjustment of ALPACA’s futures funding rate to hourly intervals may have amplified volatility. The exchange denied manipulation allegations, emphasizing its market surveillance tools.

The crypto industry faces growing scrutiny over manipulation. Recent events, like a $212 million Bitcoin order on Binance in April 2025, have raised similar concerns. According to Chainalysis, illicit crypto transactions hit $20 billion in 2024, prompting calls for stricter oversight.

With ALPACA now delisted from Binance and Tokocrypto, liquidity is expected to decline, likely depressing prices long-term. The token’s reliance on Binance Smart Chain and lack of developer activity further dims its prospects.

The ALPACA surge underscores the crypto market’s volatility and regulatory gaps. Investors face heightened risks with low-cap tokens, and manipulation concerns persist. As Binance refines its listing policies, regulators may push for clearer guidelines to protect retail traders.

Join our Telegram Channel

Join our Telegram Channel