SNX/USD is currently down more than 80% from its record level, and according to technical analysis, this crypto remains in a bear market.

Synthetix enables the creation of synthetic assets

Synthetix is a new financial primitive that powers decentralized perpetual futures, options markets, deal coordination markets, and more.

It enables traders to have some of the best price execution around, with little to no slippage and fills they can’t get elsewhere.

Simulated liquidity is the fundamental algorithm behind all synthetic assets available on Synthetix, and it ensures that traders get great liquidity with low to no slippage.

It is important to say that Synthetix has eliminated the risk of cascading liquidations due to forced selloffs, and many platforms already leverage the deep liquidity and composability of Synthetix to deliver better trades for their clients.

Traders using platforms tied into the Synthetix protocol can also get leveraged exposure to price action in any market and trade between cryptocurrencies, stocks, commodities, or currencies.

Synthetix is governed by a combination of core contributors, community members, and several elected committees and councils that are voted on by SNX stakers. The Synthetix team added:

Each governance component is assigned a specific aspect of protocol governance, and all of the components work together to ensure that the protocol is governed in a fair, transparent, and legitimate way in accordance with the direction provided by token holders.

SNX token is the utility token of the Synthetix protocol, which is used as the primary form of the collateral backing the synthetic assets available in Synthetix.

Synthetic assets or Synths can come in the form of fiat commodities, currencies, cryptocurrencies, stocks, and anything else with a price. Trades between synthetic assets generate a small fee that is distributed to SNX collateral providers.

Bears in control of SNX

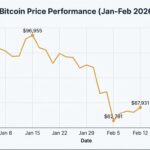

SNX token has achieved an impressive gain at the beginning of the 2021 year, and it has reached a record high of $29 on February 08. SNX is currently down more than 80% from its peak, and the risk of further decline is still not over.

The current support level stands at $4, and if the price falls below it, the next price target could be around $3 or even below.

The first resistance level stands at $8, and if the price jumps above this level, it would be a “buy” signal, and we have the open way to the $10.

Summary

Synthetix is a project that enables the creation of synthetic assets; it offers unique derivatives and exposure to real-world assets on the blockchain. Synthetic assets can come in the form of fiat commodities, currencies, cryptocurrencies, stocks, and anything else with a price.

The post Is Synthetix (SNX) buy opportunity after the current dip? appeared first on Invezz.

from Market Analysis – Invezz

Join our Telegram Channel

Join our Telegram Channel