Baillie Gifford & Co. has established a significant new position in Coinbase Global, Inc. (NASDAQ:COIN), according to recent institutional disclosure reports. The investment management firm acquired 587,422 shares of the cryptocurrency exchange operator during the third quarter, representing a major entry into the digital asset infrastructure sector.

Transaction Details and Valuation

The acquisition, first reported by Source was valued at approximately $198,249,000 at the time of the filing. This move positions Baillie Gifford as a notable institutional holder of the NASDAQ-listed firm, which serves as a primary gateway for both retail and professional cryptocurrency trading in the United States.

The purchase reflects a broader trend of institutional engagement with Coinbase. While Baillie Gifford initiated this new stake, other financial entities have also been adjusting their exposure to the stock. Evelyn Partners Investment Management is among the firms cited in recent filings as having modified its position in Coinbase Global, highlighting a period of active portfolio rebalancing among major asset managers.

Institutional Landscape and Market Activity

The third quarter saw a variety of hedge funds and institutional investors either increasing or reducing their holdings in COIN. These adjustments are typically disclosed through Form 13F filings with the Securities and Exchange Commission (SEC), providing a delayed but detailed look at the investment strategies of the world’s largest money managers.

Coinbase Global, Inc. has remained a focal point for investors seeking exposure to the blockchain economy without holding digital assets directly. As an exchange, its revenue model is heavily dependent on transaction volumes and subscription services, making it a bellwether for the health of the broader cryptocurrency market.

Broader Financial Context

The entry of Baillie Gifford & Co. is significant given the firm’s history of long-term, growth-oriented investments. Based in Edinburgh, the firm is known for taking substantial positions in technology and innovation-driven companies. The acquisition of over half a million shares suggests a strategic alignment with Coinbase’s market position during the late 2025 period.

In addition to Baillie Gifford, the market has observed varying levels of activity from other institutional players. Some firms have opted to trim their exposure to manage volatility, while others, like Evelyn Partners, continue to navigate the stock’s performance within the broader financial services sector.

Reporting and Transparency

Data regarding these transactions is compiled from public filings and processed by financial news services to provide transparency to the investing public. HoldingsChannel.com and American Banking News monitor these shifts to track where institutional capital is flowing within the technology and financial sectors.

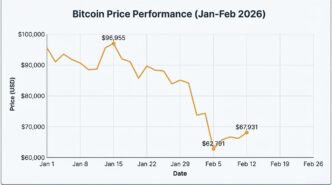

As of the reporting date of January 24, 2026, the full impact of these institutional moves on Coinbase’s long-term stock stability remains a subject of market observation. The company continues to operate as a leading platform for Bitcoin, Ethereum, and other digital assets, maintaining its status as a critical piece of financial infrastructure.

Next Steps for Investors

Market participants typically look toward the next round of quarterly filings to determine if Baillie Gifford or other major institutions have further increased their stakes or if the third-quarter activity represented a completed phase of their investment strategy. Official statements from Coinbase Global regarding its institutional ownership structure are expected during its next scheduled earnings call.

Join our Telegram Channel

Join our Telegram Channel