Bitcoin’s market dominance surged to a new cycle high of 65% on April 30, 2025, sparking heated discussions among cryptocurrency enthusiasts about the potential for an imminent “altcoin season,” where alternative cryptocurrencies could outperform the market leader. This development, tracked by TradingView, has analysts and investors closely watching a historical pattern that often precedes significant altcoin rallies.

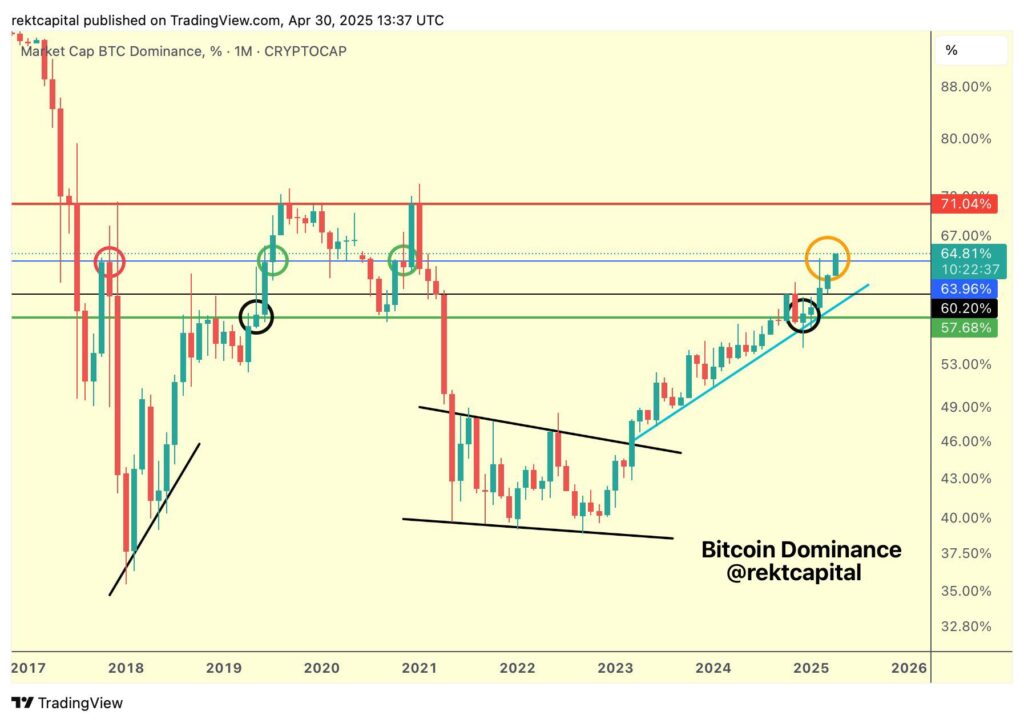

Bitcoin dominance, which measures Bitcoin’s market cap share relative to the total cryptocurrency market, reached levels not seen since December 2020, according to a chart shared by crypto analyst Rekt Capital on X.

The chart, spanning 2017 to 2025, shows Bitcoin dominance nearing a critical resistance at 71%, a level where past rejections have historically triggered altcoin seasons.

“If history repeats, the real altseason everyone is waiting for will begin once Bitcoin dominance rejects at or near 71%,” Rekt Capital wrote in a widely viewed post.

Bitcoin’s price over the past three days showed a stable yet slightly upward trend, rising from $93,809.34 on April 28 to $94,525.87 on April 30, a net increase of 0.76%, according to data from a trusted cryptocurrency provider Coinmarketcap. Its market cap followed suit, growing from $1.86 trillion to $1.88 trillion over the same period, consistent with a circulating supply of approximately 19,867,000 BTC.

Crypto trader Polaris_XBT, commenting on Rekt Capital’s analysis, noted the role of stablecoins in the dominance metric. “We’re at the range high, and altcoins will start outperforming soon,” Polaris_XBT said.

This sentiment reflects a broader market trend where peaks in Bitcoin dominance often signal a shift in capital flow toward altcoins, as investors chase higher returns in smaller, riskier assets.

Historical data supports this outlook. TradingView records show Bitcoin dominance hitting 70% in December 2017, August 2019, and December 2020, each time followed by a notable altcoin rally.

JChainsX highlighted this pattern in a recent X post: “Every single time, what followed? Altcoin season.” With dominance now at 65% and rising, a repeat could occur within weeks if the 71% resistance is tested and rejected.

Looking ahead, analysts predict that a rejection at 71% could spark a significant altcoin rally, potentially lasting weeks to months, based on historical patterns. However, a break above 71% might delay this shift, keeping Bitcoin in the spotlight. Crypto analyst Norick Vloemans forecasted on X that dominance could reach 66% within a week, advising investors to “slowly start strapping in for your famous #Altseason2025.”

As the crypto market closely monitors Bitcoin’s dominance, the coming weeks could reshape market dynamics, offering opportunities for altcoin investors while testing Bitcoin’s grip on the sector. Investors should track these levels and historical trends as indicators of what lies ahead.

Join our Telegram Channel

Join our Telegram Channel