Bitcoin (BTC) is trading at a pivotal juncture this week, hovering near $92,080 as traders brace for the Federal Reserve’s upcoming interest rate decision. While the asset has recovered from its early December low of ~$83,800, the market remains fractured between bullish year-end targets of $105,000 and bearish warnings of a “cycle inversion”.

The ‘Inverted Cycle’ & Market Sentiment

Sentiment has shifted cautiously as Bitcoin dominance hits multi-year highs of roughly 56.10%, suffocating altcoins even as BTC stabilizes. Some analysts argue that the traditional four-year cycle has “inverted,” suggesting the true bear market may be disguised by high nominal prices.

- Bearish Case: Analyst Willy Woo warns that Bitcoin‘s cycle may have peaked, noting that M2 money supply growth is no longer the primary driver for price action. Instead, the US Dollar Index (DXY) has become the “defining chart” for 2025, with a stronger dollar spelling trouble for risk assets.

- Bullish Case: Conversely, the QCP Group and other optimists view the current price action as “structural repair,” predicting that the Fed’s rate cut could serve as the catalyst for a breakout toward $100,000.

Technical Outlook: The Path to $105K

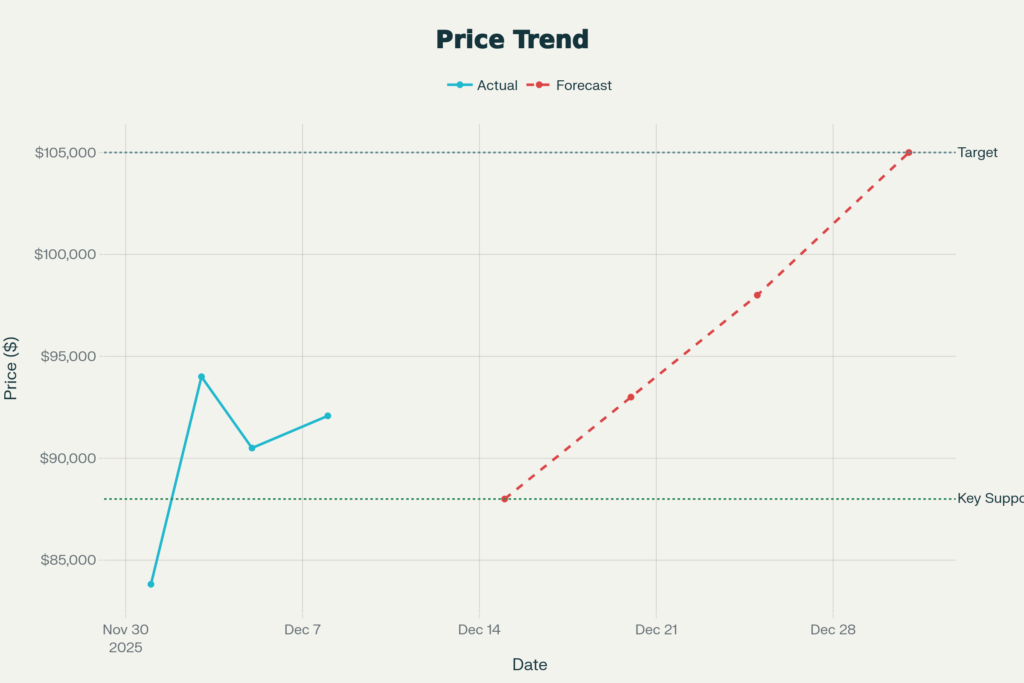

Technical analysts are eyeing a “dip and rip” scenario for the remainder of December. Michael van de Poppe has outlined a specific roadmap where Bitcoin may first need to sweep lower support levels before mounting a rally.

Michael van de Poppe (@CryptoMichNL)

“Bitcoin can reach as high as $105k in December 2025… but it may need to retest support levels between $88,000 and $90,000 before mounting a sustained rally later this month.”

Similarly, Rekt Capital emphasizes the importance of the $93,000 level.

Rekt Capital (@rektcapital)

“History suggests the price should be able to end 2025 with a green candle, by closing above $93,000 before lapsing completely in 2026. A close above this level is critical to preserve the bullish structure.”

Chart Analysis: December Forecast

The following chart visualizes the “Dip & Rip” scenario favored by analysts like van de Poppe, where a retest of the $88,000 support provides the liquidity needed for a push to $105,000.

Key Levels to Watch

- Support ($88,000 – $90,000): This zone is critical. A break below $88,000 could invalidate the bullish setup and open the door to $84,400.

- Resistance ($93,000 – $95,000): The “line in the sand” for bulls. Reclaiming this zone is necessary to trigger a run toward the psychological $100,000 barrier.

- Target ($105,000): The primary upside target for December if momentum holds and the Fed delivers a favorable rate cut.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risk. Always conduct your own research and consult with a financial advisor before making investment decisions.

Join our Telegram Channel

Join our Telegram Channel