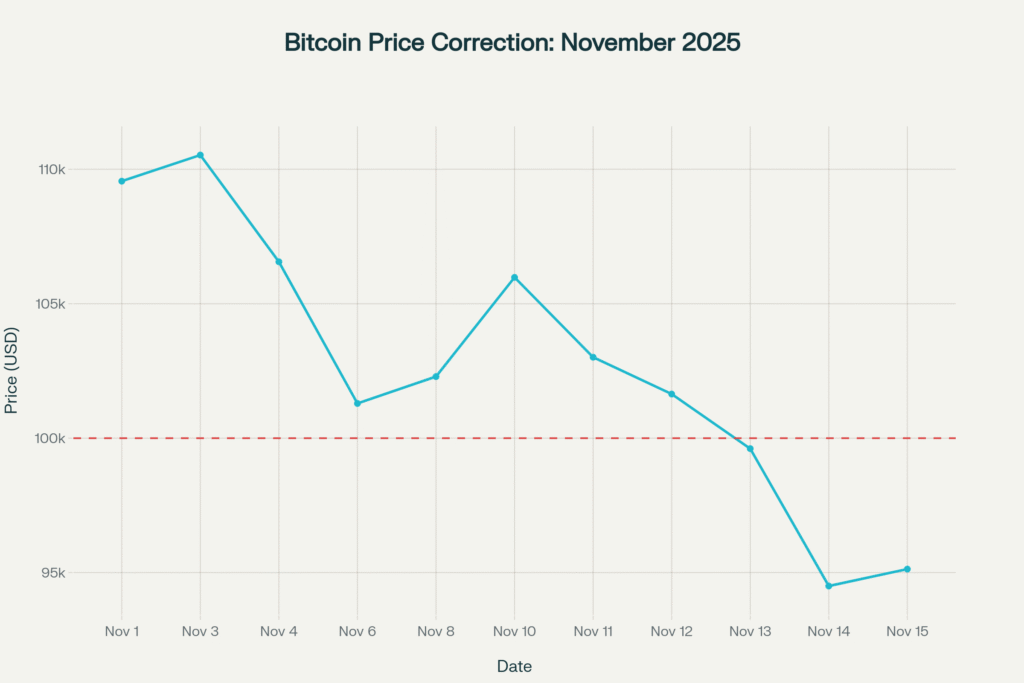

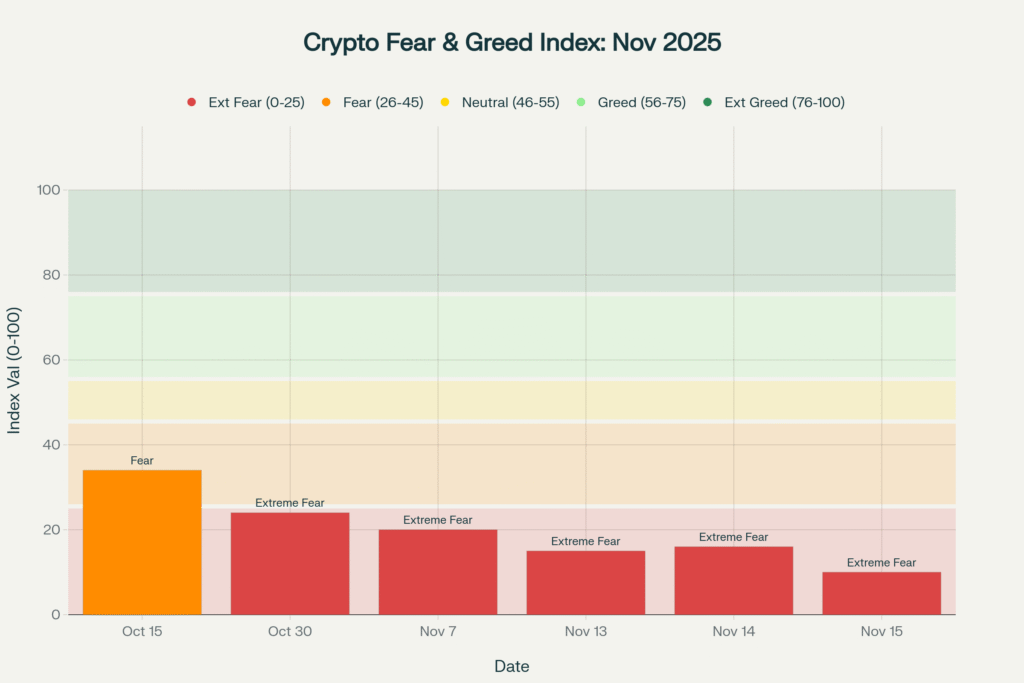

November 15, 2025 — Bitcoin has tumbled to $95,130, marking a dramatic 13.5% decline from its early November highs above $110,000 and a staggering 25% correction from its October all-time high of $126,199. The flagship cryptocurrency broke below the critical $100,000 psychological support level on November 13, triggering panic selling and pushing the Crypto Fear and Greed Index to an extreme 10—the lowest reading since February 2025.

Bitcoin has declined 13.5% from November highs, falling from $110,530 to $95,130 as extreme fear grips the market

Federal Reserve Hawkishness Triggers Crypto Selloff

The catalyst for Bitcoin‘s sharp decline came after the Federal Reserve rejected the possibility of a December rate cut, sending shockwaves through risk assets globally. Bitcoin moved in lockstep with the Nasdaq, which declined 2% as Treasury yields climbed and liquidity tightened across markets. The sell-off underscores Bitcoin’s continued sensitivity to macroeconomic catalysts, with higher rates reducing capital rotation into speculative assets.

Market analyst Timothy Peterson had warned about potential November volatility, citing a 91-92% historical correlation in Bitcoin price drops during early November, particularly around November 8th. Peterson pointed to macroeconomic factors including Q3 earnings reports and lowered expectations as contributing to the risk.

Extreme Fear Hits Market – Historical Bottom Signal?

The Crypto Fear and Greed Index has plummeted to just 10, firmly in “Extreme Fear” territory, after sliding from 34 in mid-October to 15 on November 13. Historically, such extreme fear readings have aligned with local bottoms, especially when macro-driven selling outweighs crypto-native fundamentals.

The Crypto Fear and Greed Index has plunged to 10, reflecting extreme fear as Bitcoin tests critical support levels

“The last time sentiment reached similar lows was February 27, 2025, when the index touched 10, preceded by a steep multi-week sell-off,” notes a Finbold analysis. Despite the brutal selloff, Bitcoin is now approaching a zone that has historically attracted long-term buyers, with past cycles showing that extreme fear often precedes notable price rebounds.

Analyst Predictions: Mixed Signals on Bitcoin’s Next Move

Rekt Capital: 50-Week EMA Critical for Bull Market Preservation

Popular crypto analyst Rekt Capital, who commands over 546,700 followers on X, reveals that Bitcoin has formed clusters of lower lows at the 50-week Exponential Moving Average (EMA), which intersects at $101,285. Bitcoin has been in a downtrend for the past six weeks following its rejection above $126,000 in October 2025.

“Similar patterns at the 50-week EMA have always preceded notable Bitcoin price gains,” Rekt Capital noted in his analysis. Trading below $95,000 at press time, Bitcoin must hold this critical support to preserve its bull market structure. The analyst’s long-term forecast suggests Bitcoin’s bull market will peak at around $200,000 in 2025, followed by a bear market in 2026.

Ali Martinez: Bearish Formation Warns of “Brutal Reversal”

Widely followed analyst Ali Martinez spotted a broadening top pattern on Bitcoin’s chart—a bearish formation indicated by diverging trend lines and increasing price volatility. “If this is indeed a broadening top, we could see a new all-time high first, followed by a brutal reversal,” Martinez predicted.

Martinez also warned that if Bitcoin continues trading below the Short-Term Holder Realized Price of $111,937, there’s a high probability of it moving toward the Realized Price at $56,145 or even the Long-Term Holder Realized Price at $37,815. This would represent a devastating 40-60% decline from current levels.

Michael van de Poppe: $101K Reclaim Needed for Uptrend Confirmation

Prominent crypto analyst Michaël van de Poppe states that true confirmation of a bullish reversal requires BTC to reclaim $101,000. According to van de Poppe, Bitcoin is approximately 25% below its recent high and frames the current move as a normal correction within a broader bull market.

Van de Poppe also noted that a break above $110,000 would take Bitcoin to its all-time high of $126,000, considering this resistance level as the gateway to a more substantial rally. Earlier, he emphasized that Bitcoin needs to break above $112,000 to be in “good territory” to target a new all-time high in November.

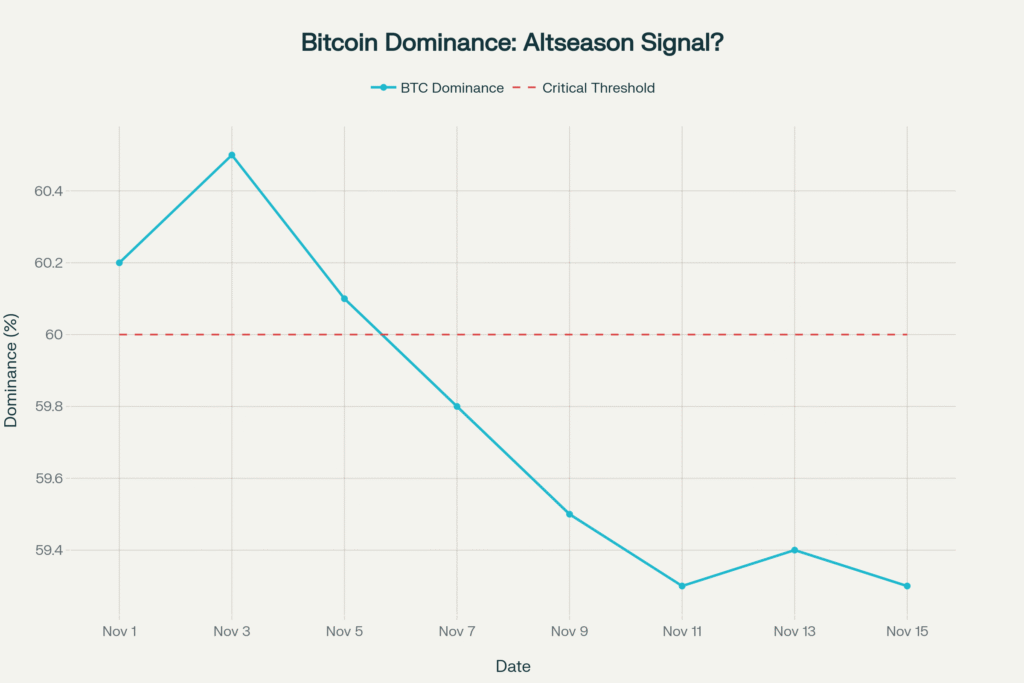

Bitcoin Dominance Drops Below 60% – Altseason Signals Emerge

In a significant development for altcoin investors, Bitcoin dominance has declined to 59.3%, falling below the critical 60% threshold that typically signals capital rotation into alternative cryptocurrencies. This marks a notable shift from early November when dominance peaked above 60.5%.

Bitcoin dominance has dropped to 59.3%, falling below the critical 60% threshold that could signal the beginning of altseason

Crypto analyst Matthew Hyland and trader Don (@DonaldsTrades) have identified a head-and-shoulders pattern on BTC dominance charts—a classic bearish structure that often precedes dominance drops and altcoin rallies. “Bitcoin Dominance is printing a head and shoulders setup, classic bearish structure. If it plays out, dominance drops and altcoins start printing. Rotation season might be closer than most think,” Don tweeted on November 9.

Kitco analyst notes that Bitcoin dominance nudged higher on BTC’s pullback but remains within the daily TBO Cloud, suggesting further decline ahead that would support an altcoin rally. A drop in BTC dominance typically signals a shift toward riskier assets, and if this trend persists, altcoins might see better performance relative to Bitcoin in the coming weeks.

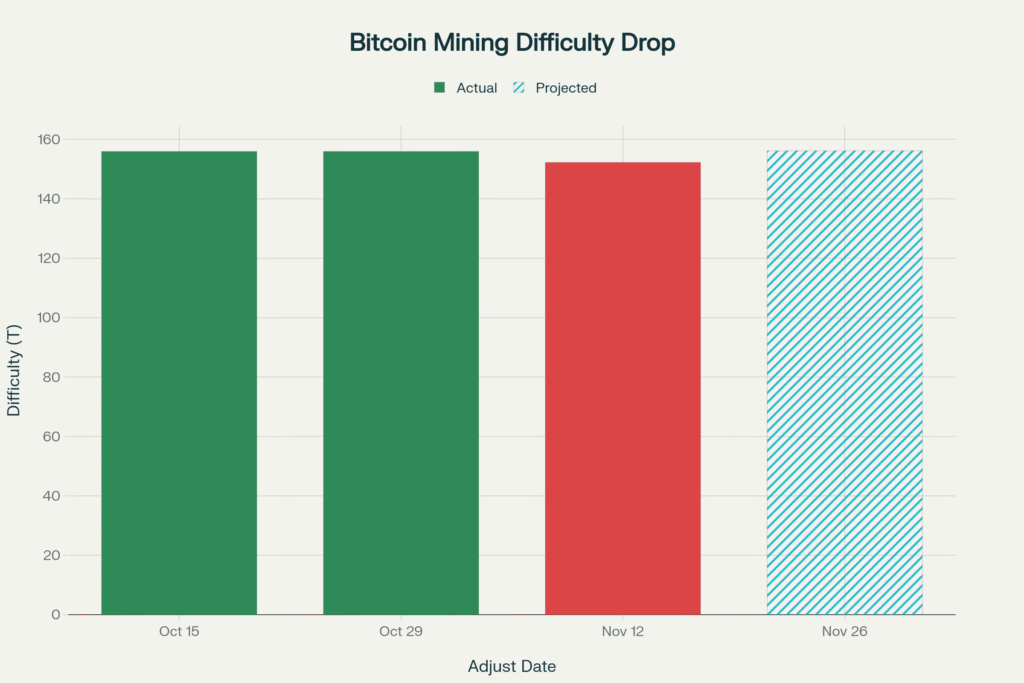

Mining Difficulty Drops 2.37% – First Decline Since October

In a rare occurrence, Bitcoin’s mining difficulty decreased by 2.37% on November 12, 2025, dropping to 152.27 trillion according to Cloverpool data. This marks the first difficulty decrease since Bitcoin reached its all-time high of 155.97 trillion in late October.

Bitcoin mining difficulty dropped 2.37% to 152.27T on November 12, but is projected to increase to 156.18T by November 26, 2025

The difficulty drop indicates that miners now need to compute approximately 152 trillion hash functions to add a block to the Bitcoin network and receive the 3.125 BTC reward. However, this decline may be temporary—the next difficulty adjustment on November 26 is projected to increase difficulty to 156.18 trillion, a 2.57% rise from current levels.

The mining difficulty adjustment reflects network health and miner profitability. While the recent drop suggests some mining operations may have temporarily reduced activity due to price volatility, the projected rebound indicates strong long-term miner confidence in Bitcoin’s value proposition.

Institutional Demand Shows Signs of Recovery

After months of declining inflows, US-based spot Bitcoin ETFs have recorded $524 million in cumulative net inflows—the highest single-day inflow since October 7. According to data from Farside Investors, this marks a significant recovery in institutional demand and indicates a return of “risk appetite” in the crypto market.

Ki Young Ju, founder and CEO of CryptoQuant, emphasized that “investments from ETFs and Michael Saylor’s Strategy have been the two main vehicles driving demand for Bitcoin’s price this year”. The return of strong institutional inflows suggests that both institutional and retail investors are once again looking to build positions at these lower levels.

However, traders should note that Bitcoin’s 14-day RSI sits at 76.46, deep in “overbought” territory prior to this recent correction, suggesting the rally was overheated and due for consolidation.

Key Support and Resistance Levels

Bitcoin is currently navigating a pivotal phase between critical technical levels:

Support Levels:

- $95,000-$96,000 – Current price zone with historical buying interest

- $90,000 – Major support where breakdown could lead to deeper retracements toward $75,000

- $56,145 – Realized Price (if Short-Term Holder support breaks)

Resistance Levels:

- $101,000 – Key level for uptrend confirmation

- $108,000-$110,000 – Critical resistance that must flip to support

- $112,000 – Gateway to targeting new all-time highs

- $117,000-$120,000 – Supply zone with heavy profit-taking pressure

- $126,199 – Current all-time high from October 2025

November Historically Bitcoin’s Best Month

Despite the brutal correction, November has historically been Bitcoin’s strongest month, with an average return of 42.5%. Analysts note that Bitcoin’s current consolidation between $100,000-$105,000 follows a remarkable year that saw the cryptocurrency breach the six-figure mark and touch new all-time highs above $126,000.

“Looking ahead, I think November will likely bring consolidation or a modest recovery—not a full-on rally unless a strong catalyst appears,” stated market analyst Andrew Lin in a BeInCrypto report. “If trade tensions worsen, Bitcoin could retest the $90,000 area. But if support holds above $110,000, we could easily see a 10-20% rebound toward $120,000-$140,000 by the end of the month”.

Altseason Finally Arriving? What to Watch

Several indicators suggest that the long-awaited altseason could be materializing:

- Bitcoin Dominance Below 60% – The critical threshold has been breached, with technical patterns suggesting further decline

- Head and Shoulders Pattern on BTC.D – Classic bearish structure pointing to capital rotation

- Improving Onchain Metrics – DeFi total value locked and transactional volume remain robust in leading ecosystems

- Ethereum Fusaka Upgrade – Mainnet launch expected in early December, providing a key catalyst

“Early signs suggest November 2025 could bring chances for altcoins. Lower Bitcoin dominance, changing sentiment, and more liquidity may support higher-risk assets,” notes a Cryptomus analysis. Both retail and institutional investors seem interested again, though caution is warranted as early gains could be temporary.

Market Outlook: Consolidation or Deeper Correction?

Bitcoin finds itself at a critical juncture. The cryptocurrency must hold support above $90,000-$95,000 to preserve its bull market structure, while a reclaim of $101,000 would signal that the correction has ended and a new uptrend is forming.

Bullish Case:

- Extreme fear readings historically mark local bottoms

- Institutional ETF inflows recovering strongly

- Mining fundamentals remain healthy with difficulty projected to rebound

- Historical November strength could drive year-end rally

- Altseason rotation may provide fresh capital into crypto markets

Bearish Case:

- Federal Reserve maintaining hawkish stance with no rate cuts in sight

- Broadening top pattern suggesting potential for brutal reversal

- Break below $95,000 could trigger cascade to $75,000-$90,000 zone

- Macroeconomic headwinds with rising Treasury yields

Predictions for the rest of 2025 vary widely, with bullish analysts projecting $120,000-$140,000 by December if current support holds. More aggressive forecasts even suggest $150,000-$200,000 if historical bull market patterns play out. However, bears warn that failure to hold current levels could see Bitcoin retesting $75,000-$90,000 before any sustainable recovery.

Conclusion

Bitcoin’s 25% correction from all-time highs has pushed the Crypto Fear and Greed Index to extreme fear levels not seen since February 2025. While the selloff has been brutal, history suggests that such capitulation events often present attractive entry points for long-term investors. The key question now is whether Bitcoin can hold the $90,000-$95,000 support zone and reclaim $101,000 to confirm a bullish reversal.

With Bitcoin dominance falling below 60%, institutional flows recovering, and technical patterns suggesting potential altseason rotation, the next few weeks will be critical in determining whether this correction represents a healthy consolidation before new highs or the beginning of a deeper bear market. Traders should monitor the $101,000 level closely as the key battleground between bulls and bears.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risk. Always conduct your own research and consult with a financial advisor before investing.

Join our Telegram Channel

Join our Telegram Channel