Current Bitcoin Price: $110,670.02 (-0.04%) as of September 6, 2025

Current Bitcoin Dominance: ~58.47% (September 2025)

As Bitcoin trades around the psychologically important $110K level, the cryptocurrency market finds itself at a critical juncture in September 2025. With Bitcoin dominance declining to 58.47% and crypto Twitter analysts coining the term “Sendtember” to describe historically weak September performance, the market is showing signs of a potential shift toward altcoin outperformance.

Current Market Dynamics and Price Action

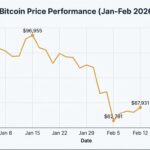

Bitcoin has experienced notable volatility in recent weeks, declining from August highs above $123K to current levels around $110,670. The digital asset closed August at $108,269, marking a challenging end to what was initially a strong summer rally. According to current market data, Bitcoin’s recent price action reflects broader market uncertainty as investors navigate macroeconomic headwinds and seasonal trading patterns.

September’s Historical Performance: “Sendtember” Phenomenon

Crypto analyst Kaleo (@CryptoKaleo) highlighted the “Sendtember” narrative on August 21, 2025, referencing Bitcoin’s historically weak September performance. This seasonal pattern has become a focal point for traders, with many viewing September weakness as a potential setup for “Uptober” rallies.

The term “Sendtember” has gained traction on crypto Twitter, describing the tendency for Bitcoin to underperform in September before rallying in October. This pattern aligns with traditional financial markets, where September is often the weakest month for equities.

Bitcoin Dominance Decline Signals Market Shift

One of the most significant developments in the current market cycle has been Bitcoin’s dominance declining from 65% in May 2025 to approximately 58.47% in September 2025. This 6.5 percentage point decline represents a substantial shift in market dynamics, historically associated with altcoin rotation.

According to recent analysis, such sharp declines in Bitcoin dominance typically precede periods of altcoin outperformance. The current 58% level is approaching the critical 50% threshold that many analysts consider necessary for a full “altcoin season.”

Bitcoin dominance falling from 65% to 58% signals potential capital rotation into altcoins. Watch for breaks below 55% for confirmation of altseason 🚀 — Market Analysis (@hypothetical_analyst) September 5, 2025

Twitter Analyst Predictions and Market Sentiment

PlanB’s Stock-to-Flow Model Outlook

The renowned Bitcoin analyst PlanB (@100trillionUSD) continues to maintain his long-term bullish stance despite recent volatility. In his August closing analysis, PlanB noted:

- Bitcoin August closing price: $108,269

- 200-week moving average: $52k and rising

- Realized cost price: $52k and rising

- 14-month RSI: 67 (uptrend)

PlanB recently stated his belief that “bitcoin average price will be ~$0.5m this halving cycle (2024-2028),” maintaining his Stock-to-Flow model projections despite recent market turbulence.

Bitcoin August closing price: $108,269

200w moving average: $52k and rising

Realized cost price: $52k and rising

14m RSI (color overlay): 67 (uptrend)

Bull market confirmed 📈 — PlanB (@100trillionUSD) September 1, 2025

Rekt Capital’s Cycle Analysis

Prominent crypto analyst Rekt Capital (@rektcapital) has provided valuable insights into Bitcoin’s current cycle position. According to his analysis, the next bull market peak could occur 518-546 days after the halving, placing potential peak dates in mid-September to mid-October 2025.

Recent reports suggest Rekt Capital noted that “Bitcoin has gained 1.7% in the last 24 hours, soaring past $112,500 levels,” indicating potential momentum building despite September’s historically weak performance.

Expert predictions from Rekt Capital suggest Bitcoin could potentially reach $245,000 by mid-September or mid-October 2025 if historical patterns hold and volume picks up significantly.

Anthony Pompliano’s Long-term Perspective

Bitcoin advocate Anthony Pompliano (@APompliano) recently reflected on Bitcoin’s remarkable growth trajectory, noting that “Bitcoin was a $200 billion market cap at the time. Today it is more than $2 TRILLION,” emphasizing the long-term success of his previous analysis.

Altcoin Season Indicators and Market Rotation

The Altcoin Season Index currently shows mixed signals, with Bitcoin dominance at 58.47% inversely correlating with altcoin performance. Several key indicators suggest we may be entering the early stages of altcoin outperformance:

Key Altcoin Season Metrics:

- Bitcoin Dominance: 58.47% (down from 65% peak)

- Altcoin Season Index: 52 (down from 60+ YTD)

- ETH Performance: 23% surge over the past month

- Total3 Index: Showing breakout patterns

Recent analysis indicates that “Fed rate cuts could trigger risk appetite, historically bullish for altcoins,” providing fundamental support for the altcoin rotation thesis.

Technical Analysis and Price Targets

From a technical perspective, Bitcoin is currently testing crucial support levels around $110K. Key levels to monitor include:

Support Levels:

- Primary Support: $108K-$110K

- Secondary Support: $105K-$107K

- Critical Support: $100K psychological level

Resistance Levels:

- Immediate Resistance: $115K-$118K

- Medium-term Target: $125K-$130K

- Cycle High Target: $150K-$200K (Q4 2025)

Market analysis suggests that “Bitcoin is challenging a two-week downtrend on the daily chart. A daily close above the trendline may confirm a breakout.”

Options Expiry and Market Volatility

The crypto derivatives market is showing significant activity, with $3.8 billion in Bitcoin options set to expire, raising concerns about September volatility. This large options expiry could create additional price pressure in the near term.

Market Outlook: From “Sendtember” to “Uptober”

Despite current weakness, several factors support a bullish outlook for Q4 2025:

- Historical Patterns: September weakness often precedes strong Q4 performance

- Institutional Adoption: Continued corporate and institutional Bitcoin accumulation

- Halving Cycle: Post-halving dynamics historically support higher prices 12-18 months later

- Altcoin Rotation: Declining Bitcoin dominance could indicate healthy market diversification

Analyst predictions suggest that “Bitcoin dominance has been in free fall for the last few months and now sits below 60%. Falling Bitcoin dominance indicates that capital is flowing into alternative cryptocurrencies.”

Conclusion: Strategic Positioning for Market Transition

Bitcoin’s current position around $110K represents both a test of key support levels and a potential inflection point for the broader cryptocurrency market. While “Sendtember” seasonality creates near-term headwinds, the declining Bitcoin dominance to 58.47% signals a potential shift toward altcoin outperformance.

Twitter analysts remain cautiously optimistic about Bitcoin’s long-term trajectory, with PlanB maintaining his $500K cycle target and Rekt Capital identifying potential cycle peaks in Q4 2025. The current market structure suggests we may be transitioning from Bitcoin-focused gains to broader cryptocurrency market participation.

For investors, the current environment presents both challenges and opportunities. While Bitcoin consolidates around $110K support, the declining dominance creates favorable conditions for selective altcoin exposure. The key will be monitoring whether Bitcoin can hold current support levels while altcoins begin to outperform on a relative basis.

As we progress through September, market participants should watch for:

- Bitcoin’s ability to hold $108K-$110K support

- Further declines in Bitcoin dominance below 55%

- Altcoin breakouts relative to Bitcoin

- Volume confirmation of any directional moves

The combination of seasonal patterns, cycle analysis, and dominance metrics suggests we may be approaching a critical transition phase in the 2025 bull market, with “Sendtember” potentially setting the stage for a strong Q4 finish.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risk and volatility. Always conduct your own research before making investment decisions.

Join our Telegram Channel

Join our Telegram Channel