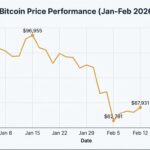

Bitcoin’s recent price decline has caught the attention of crypto traders, with some seeing it as a potential buying opportunity, according to a post by market analyst Rekt Capital on X.

According to Rekt Capital, a well-known cryptocurrency analyst, Bitcoin has hit a lower high on its daily chart and dropped to a Relative Strength Index (RSI) of 28. This level, Rekt Capital notes, has historically signaled that Bitcoin’s price is either at a bottom or very close to it, typically within 2% to 8% of the lowest point in its cycle. The post, shared on March 8, 2025, includes a chart showing Bitcoin’s price movements and RSI, highlighting the current bearish trend but also pointing to potential recovery signs.

#BTC

— Rekt Capital (@rektcapital) March 8, 2025

Bitcoin's Daily RSI equalled 2022 Bear Market RSI levels (RSI=23.93) when price crashed into the high $70,000s

The only lower Daily RSI in this cycle was back in August 2023 (RSI=18.28)

Throughout this cycle, each visit into sub-25 RSI resulted in a trend reversal to the… pic.twitter.com/78XE65SJFo

The investigation into Bitcoin’s market behavior reveals that the RSI, a tool used to measure the speed and change of price movements, often indicates when an asset like Bitcoin is oversold—meaning it might be undervalued and ready for a rebound. Confirmed by multiple crypto market analysts, an RSI below 30, as seen now, suggests Bitcoin could be nearing a turning point. Sources say this pattern has repeated throughout Bitcoin’s market cycles, giving traders hope despite the recent 4.23% drop in the past 24 hours, bringing its price to $87,686 USD as of March 8, 2025.

Previously, Bitcoin has experienced similar downturns, such as the 80% drop from its peak of $69,000 in November 2021 to $15,476 in November 2022, before rebounding significantly. In the wake of those events, experts believe this current dip could align with Bitcoin’s four-year market cycle, influenced by events like the Bitcoin halving, which reduces the supply of new coins and often drives price increases over time.

According to sources, Tom Lee, co-founder of Fundstrat Global Advisors, predicts Bitcoin could reach $250,000 by the end of 2025, driven by factors like institutional adoption and regulatory changes. In a statement, Bitwise Asset Management also forecasts a potential rise to $200,000, citing similar market catalysts. These expert opinions contrast with the current bearish sentiment but underline the possibility of a strong recovery.

Officials and traders describe the situation as critical, urging investors to closely monitor Bitcoin’s RSI and price movements for signs of a reversal. The immediate impact could see increased buying activity if Bitcoin stabilizes or shows signs of upward momentum, potentially stabilizing the broader crypto market.

In summary, Bitcoin’s recent price drop to an RSI of 28 has sparked cautious optimism among traders, with Rekt Capital’s analysis suggesting a potential bottom is near. The bottom line is that as Bitcoin’s market continues to evolve, investors are advised to stay informed and watch for further developments in this dynamic crypto landscape. Key takeaways include the historical significance of low RSI levels and the broader context of Bitcoin’s cyclical nature, offering hope amidst the current volatility.

Join our Telegram Channel

Join our Telegram Channel