Bitcoin hit an intraday high of $97,900 on Friday, May 2, 2025, pushing the cryptocurrency market’s total capitalization to $3.03 trillion as easing U.S.-China trade tensions and strong U.S. economic data sparked a broad market rally. The surge, reported by Bitcoindotcom, comes amid renewed optimism in global markets, with the Nasdaq climbing 1.8% on gains in technology stocks.

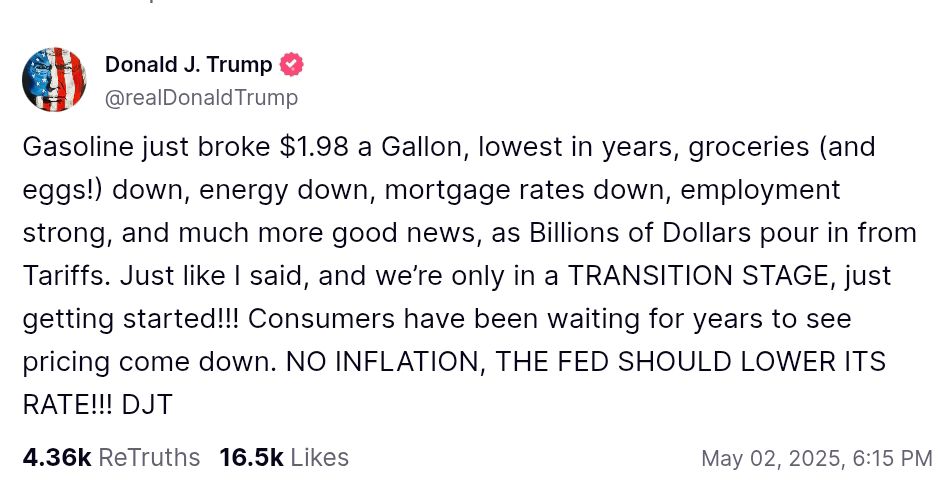

The rally follows China’s signal of willingness to negotiate trade deals, a development that has eased fears of escalating tensions with the U.S. Former President Donald Trump, whose tariff policies have influenced trade dynamics, claimed that “billions of dollars” are flowing into the U.S. from tariffs.

In a statement on Friday, Trump urged the Federal Reserve to cut interest rates, arguing that lower rates would further fuel economic growth. “The Fed needs to act fast—our economy is roaring, and we can’t let high rates hold us back,” he said.

Financial markets responded positively, with the Nasdaq’s 1.8% gain driven by technology companies like ON Semiconductor and Microchip Technology, both of which rose more than 4%, according to Nasdaq data. Strong U.S. jobs data released the same day further boosted investor confidence, though specific figures were not immediately available.

The cryptocurrency market’s rise reflects broader trends, with large investors accumulating 43,100 Bitcoin in late April—worth roughly $4 billion—reducing available supply and driving prices higher. However, some experts caution that Trump’s tariff policies could pose risks.

A Forbes report from June 2024 noted that escalating U.S.-China trade conflicts could increase inflation, potentially affecting Bitcoin prices in the short term. The Federal Reserve, already under pressure from Trump, has resisted rate cuts amid concerns about inflation.

Looking ahead, analysts are monitoring whether Bitcoin can break the $98,000 barrier, a key psychological threshold for traders. The Federal Reserve’s next meeting and ongoing U.S.-China trade talks will likely influence markets in the coming weeks. If tensions rise again, Bitcoin’s appeal as a safe-haven asset could be tested, while sustained economic growth might push it to new highs.

In summary, Bitcoin’s climb to $97,900 highlights the cryptocurrency market’s sensitivity to global economic shifts. As trade dynamics and monetary policy debates continue, investors remain watchful for the next catalysts that could either drive Bitcoin past $98,000 or lead to a pullback.

Join our Telegram Channel

Join our Telegram Channel