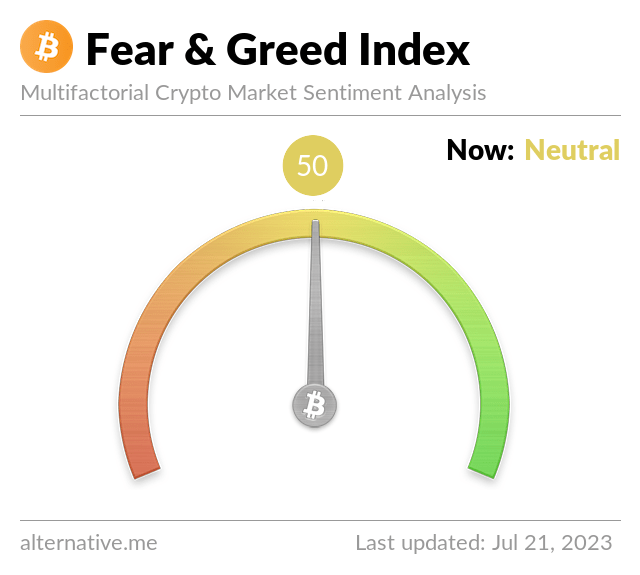

The Bitcoin Fear and Greed Index has dropped into the “neutral” zone, indicating cooling investor sentiment for the world’s largest cryptocurrency.

What is the Fear and Greed Index?

The Fear and Greed Index is a metric developed by Alternative.me that tracks investor sentiment in the crypto markets. It factors in five components:

1) Bitcoin‘s volatility (15%)

2) Dominance of the crypto market cap (15%)

3) Survey results on Google Trends (15%)

4) Bitcoin’s price movements (25%)

5) Social media mentions (30%)

The index gives a score from 0 to 100:

- 0 to 25 = Extreme fear

- 25 to 50 = Fear

- 50 = Neutral

- 50 to 75 = Greed

- 75 to 100 = Extreme greed

Extreme fear can indicate times when investors are being overly pessimistic, potentially presenting buying opportunities. Conversely, extreme greed can point to a market that has become overheated.

The Index Currently Sits at 50

After spending much of June and early July in “greed” territory, the index recently dropped into the neutral zone. As of writing, it sits at exactly 50.

This reflects several factors:

1) Bitcoin’s price has been rangebound between $29,000 and $31,000 for over five weeks now, indicating a lack of momentum in either direction.

2) Volatility has declined significantly from the highs seen in March and April after the TerraUSD collapse.

3) Social media mentions of Bitcoin have trended downward, another sign of cooling sentiment.

4) Poll results from Google Trends show only modest interest in Bitcoin relative to past cycles.

In short, the neutral Fear and Greed reading indicates that investors are neither ebullient nor panicking about Bitcoin’s short-term prospects. The crypto appears to have entered a holding pattern, with traders waiting for a clear catalyst to break the range.

What This Could Mean Going Forward

A neutral sentiment score does not necessarily predict which way the market will move next. It simply reflects the current mood of investors.

However, history shows that extreme Fear readings have often coincided with local bottoms, while extreme Greed has marked tops. A neutral-to-greedy reading could signal upside potential, while a transition to extreme Fear may precede a rally.

Of course, other factors beyond sentiment will ultimately determine Bitcoin’s trajectory. Regulatory developments, macroeconomic conditions and technical factors like chart patterns all play a role.

Still, the Fear and Greed Index can offer a useful, if imperfect, gauge of market psychology. A transition from neutral sentiment back into greed would likely require some catalyst – either fundamental news or a break of technical resistance – to excite investors once more.

For now, the message seems clear: Investors are uncertain, with optimism and pessimism balanced in a state of ambivalence. The market still appears to be searching for its next big move.

In summary, the Bitcoin Fear and Greed Index sinking into the neutral zone indicates that investor sentiment has cooled off considerably from peaks in June. Bitcoin’s price stagnation, declining volatility and social media mentions all point to waning excitement and eagerness among traders.

A neutral reading does not guarantee future moves in either direction, but history suggests that extreme fear often accompanies market bottoms while extreme greed marks tops. For now, ambivalent sentiment underscores the lack of momentum and clarity in the crypto market.

Source: CoinDesk ↗

Join our Telegram Channel

Join our Telegram Channel