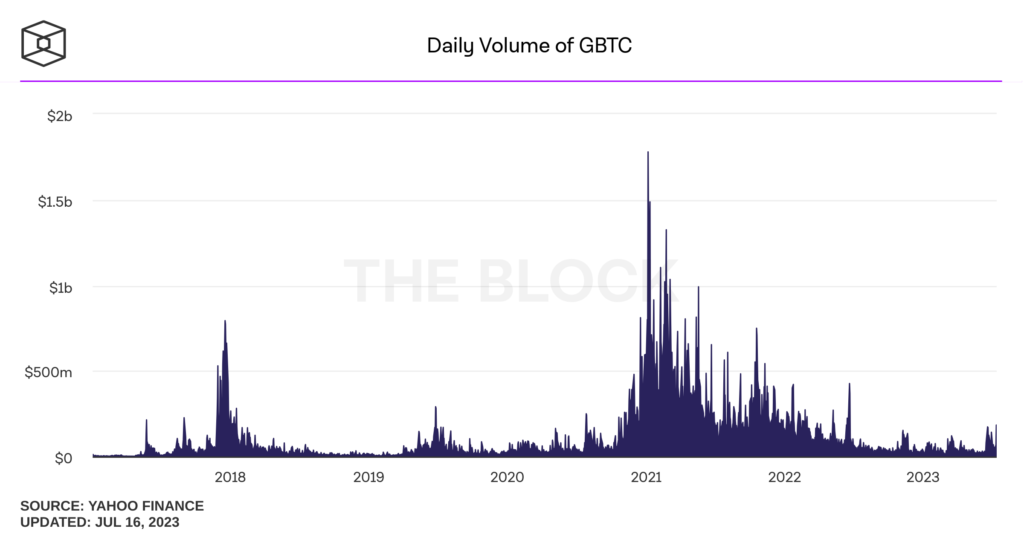

Grayscale’s GBTC, the largest Bitcoin investment product, has seen trading volumes surge to the highest levels of the year on July 13, according to data from cryptocurrency news and research outlet The Block.

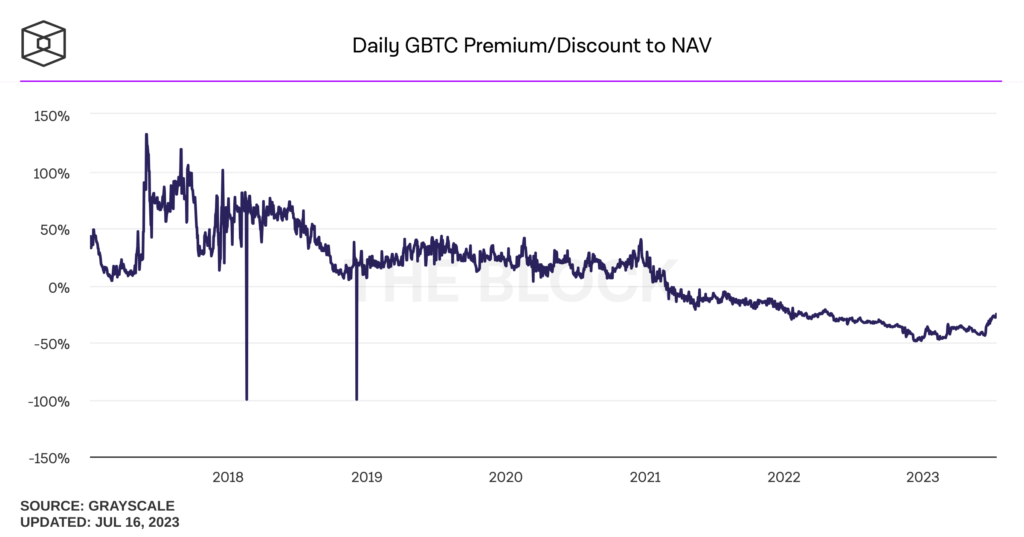

The spike in volumes comes as Grayscale prepares to file an upgraded spot Bitcoin ETF with the SEC while also seeing increasing competition from other spot ETF filings. Additionally, GBTC’s discount to net-asset-value has tightened significantly in recent weeks.

Volume Hits $183 Million on July 13

The Block’s database shows that GBTC’s daily trading volume reached as high as $183 million on July 13, topping the $170 million reached on June 20.

This surge in interest comes as Grayscale has announced plans to fight the SEC’s rejection of its previous GBTC Bitcoin ETF application by suing the regulator. Meanwhile, competitors like BlackRock have filed their own spot Bitcoin ETF applications, heating up the race to be the first approved.

Discount Narrows From -44% to -28% Since Mid-June

The discount that GBTC has traditionally traded at relative to the value of the underlying Bitcoin holdings has also narrowed considerably in recent weeks.

On June 13, GBTC was trading at a massive -44% discount but by July 10 that had tightened to a -28% discount. A narrowing discount indicates increasing demand for Grayscale’s product from investors.

In summary, a combination of Grayscale fighting for SEC approval, competition from other fund filings, and a narrowing price discount have all contributed to the surge in volumes for GBTC seen in mid-July – pointing to rising investor interest in Bitcoin investment products. The Block’s data provides valuable insight into these trends shaping the cryptocurrency industry.

Join our Telegram Channel

Join our Telegram Channel