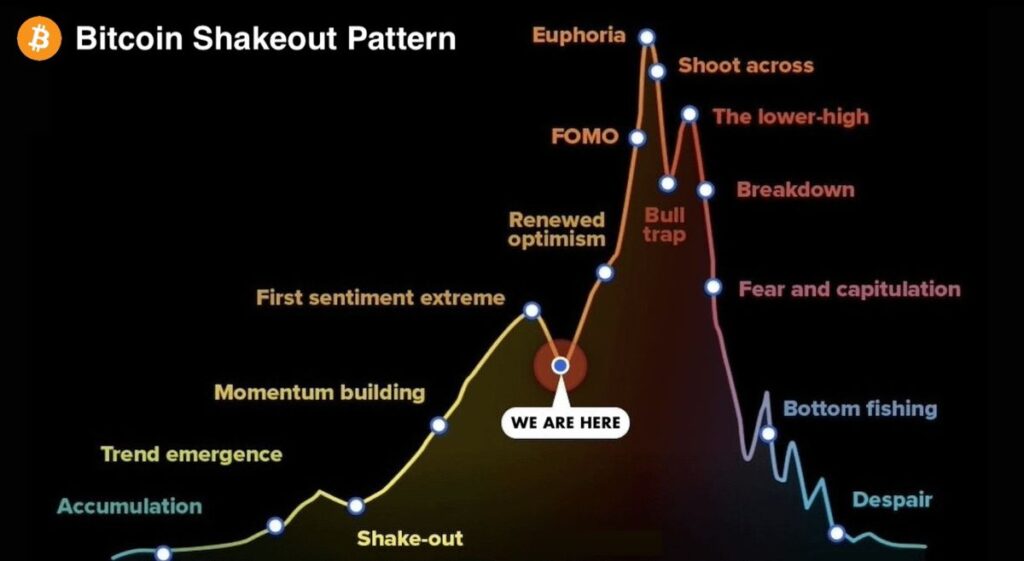

In a striking development for cryptocurrency enthusiasts, a detailed X post by crypto analyst Klarck on March 13, 2025, suggests Bitcoin could surge to $200,000 within two weeks, following a significant Q1 2025 “shakeout” pattern echoing 2021’s market dynamics. This revelation has ignited fervent discussions among tech-savvy investors tracking Bitcoin’s trajectory.

According to Klarck’s thread, Bitcoin is currently experiencing a “false dip,” a market manipulation tactic that historically precedes explosive rallies. The post, featuring a chart of Bitcoin’s price movements, highlights Q1 2021 and Q1 2025 as periods of sharp declines—drops of 40% in 2021, followed by a 120% surge—before entering “altseason,” a phase of robust growth for alternative cryptocurrencies.

Klarck’s analysis predicts Bitcoin could reach $120,000 soon, with a potential peak at $200,000, driven by historical patterns post-halving and market psychology.

Furthermore, the chart delineates Bitcoin’s “shakeout” as a deliberate price drop to eliminate weaker investors, a strategy Klarck describes as creating “the largest false dip in the market over the past three years.” This aligns with data from CoinCodex, where Bitcoin’s price is forecasted to hit $110,613 by April 13, 2025, a 35.04% increase, though current sentiment remains bearish with a Fear & Greed Index of 27, signaling market caution.

However, Klarck’s optimism contrasts with this, pointing to March 2025’s historical post-halving growth, as noted in Changelly’s prediction of Bitcoin not falling below $82,595.08 this month, with a possible peak at $109,306.87.

Historically, Bitcoin’s price behavior after halving events—reducing mining rewards every four years—has triggered bull runs, as seen in 2017 and 2021.

#BTC is now just below the ~$84000 key resistance

Bitcoin is one Daily Close above this level from moving further to the upside$BTC #Crypto #Bitcoin https://t.co/35uPNEENNo pic.twitter.com/GxbfqW7TgI— Rekt Capital (@rektcapital) March 14, 2025Recent Posts

In the wake of the latest halving, Klarck’s thread suggests a repeat of this cycle, with Bitcoin consolidating around key resistance levels like $84,000, as Rekt Capital recently noted on X, observing Bitcoin forming a “Higher Low” within a CME gap between $82,245 and $87,045—a bullish signal for potential upward momentum.

According to sources, including Reddit’s r/CryptoCurrency discussions, such shakeouts are often viewed as traps by institutional players to profit from retail investor panic.

Klarck’s post also identifies five altcoins—zkSync ($ZK), Aethir ($ATH), Animecoin ($ANIME), Golem Network ($GLM), and Berachain ($BERA)—poised for 100x gains during the anticipated altseason, citing their market caps and technological innovations like zkSync’s Ethereum scaling and Aethir’s decentralized GPU infrastructure.

The impact of this analysis is profound, urging immediate attention from investors navigating Bitcoin’s volatility. While Klarck’s predictions are speculative, they resonate with technical indicators and historical data, though traders must exercise caution given the market’s bearish sentiment and potential for further dips. Insiders reveal that monitoring CME gaps and resistance levels will be critical in the coming weeks.

In summary, Klarck’s detailed breakdown of Bitcoin’s Q1 2025 shakeout offers a compelling narrative of impending growth, tempered by the need for rigorous risk management. The bottom line is that as Bitcoin approaches key price points, tech-savvy investors should stay informed, leveraging tools like TradingView for real-time analysis, while preparing for both opportunities and uncertainties in this dynamic market.

Key takeaways include the historical significance of post-halving rallies, the role of shakeouts in market cycles, and the potential for altcoin surges, all of which demand careful scrutiny as developments unfold.

Join our Telegram Channel

Join our Telegram Channel