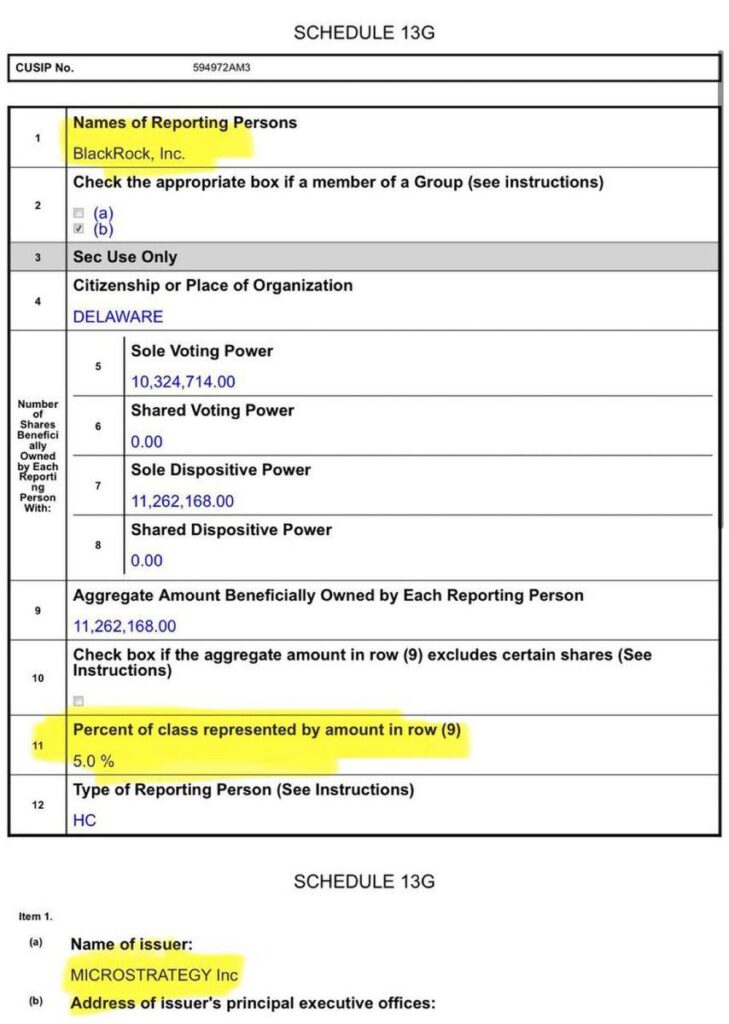

BlackRock has increased its ownership in Strategy (formerly MicroStrategy) to 5%, acquiring 11.2 million shares valued at $3.67 billion, per a February 6 SEC filing. The move underscores institutional confidence in Strategy’s Bitcoin-heavy strategy, as the firm holds 471,107 BTC ($46 billion) and pursues a $42 billion fundraising plan despite a $670 million Q4 2024 loss. Strategy’s stock rose 2.8% pre-market to $331.90, reflecting market optimism.

Market Context

Strategy, rebranded from MicroStrategy in 2024, has pivoted from business analytics to become the largest corporate Bitcoin holder. Its “21/21 Plan” aims to raise $42 billion via debt and equity to expand its BTC reserves, having already secured $20 billion. This aggressive accumulation aligns with growing institutional interest in Bitcoin as a hedge against inflation, exemplified by BlackRock’s $55.5 billion Bitcoin ETF—the largest in the U.S..

BlackRock’s stake increase follows Strategy’s Nasdaq debut of its perpetual preferred stock (STRK), which surged 5% pre-market after a 2% gain on its first trading day. The asset manager’s endorsement signals broader acceptance of Bitcoin-linked equities, even as traditional finance giants like Vanguard maintain crypto skepticism while holding positions in Bitcoin-centric firms.

Technical Analysis

A Schedule 13G filing indicates passive investment, meaning BlackRock does not seek to influence Strategy’s management—contrasting with the activist intent of a Schedule 13D. The filing deadline was February 14, but BlackRock disclosed early on December 31, 2024.

Prasanna Peshkar, a CryptoTicker analyst, notes, “BlackRock’s stake reflects a calculated bet on Bitcoin’s long-term appreciation through a regulated corporate vehicle. Strategy’s hybrid model—part tech firm, part Bitcoin treasury—offers indirect exposure with mitigated regulatory risks”. The 0.91% increase from 4.09% ownership in September 2024 involved purchasing 1.78 million shares, likely timed with Strategy’s rebranding and STRK launch.

Market Impact

BlackRock’s endorsement has buoyed Strategy’s stock, which often mirrors Bitcoin’s price movements. James Van Straten, a CoinDesk analyst, explains, “Institutional stakes like BlackRock’s provide stability, attracting retail and institutional capital. This creates a feedback loop: rising BTC prices lift MSTR, which in turn validates further institutional interest”.

However, risks persist. Strategy’s Q4 loss highlights volatility-linked vulnerabilities, and its debt-funded Bitcoin purchases ($20 billion raised via convertible notes) could strain liquidity if BTC prices dip. Meanwhile, STRK’s 650,000-shale trading volume on its Nasdaq debut suggests retail enthusiasm but also potential overextension.

Future Outlook

BlackRock’s stake could foreshadow expanded Bitcoin product offerings, including a Swiss-based Bitcoin ETP targeting European markets. Larry Fink, BlackRock’s CEO, has termed Bitcoin a “hedge against monetary depreciation,” advocating 1-2% portfolio allocations. Such moves may accelerate Bitcoin’s mainstream adoption, particularly as U.S. states like Kentucky legislate Bitcoin reserves.

Strategy’s trajectory hinges on Bitcoin’s price and regulatory clarity. Its $42 billion fundraising goal—if achieved—would nearly double its BTC holdings, cementing its status as a crypto bellwether. Yet, as Peshkar cautions, “Strategy’s success is inextricably tied to Bitcoin’s volatility. Investors must weigh institutional validation against macroeconomic and regulatory headwinds”.

Institutional momentum suggests Bitcoin’s role in portfolios will expand, but Strategy’s high-risk, high-reward model remains a litmus test for crypto’s corporate viability. As BlackRock deepens its crypto footprint, the line between traditional finance and digital assets continues to blur.

Join our Telegram Channel

Join our Telegram Channel