In a move that has sent ripples through the cryptocurrency market, financial giant BlackRock transferred $150 million worth of Bitcoin (BTC) from its iShares Bitcoin Trust (IBIT) ETF to Coinbase Prime, according to a post by Arkham, a leading cryptocurrency intelligence platform, on X February 25, 2025.

The transaction, described as an outflow from BlackRock’s flagship Bitcoin ETF, has ignited heated debate among investors and analysts about the firm’s intentions and the broader implications for the crypto market.

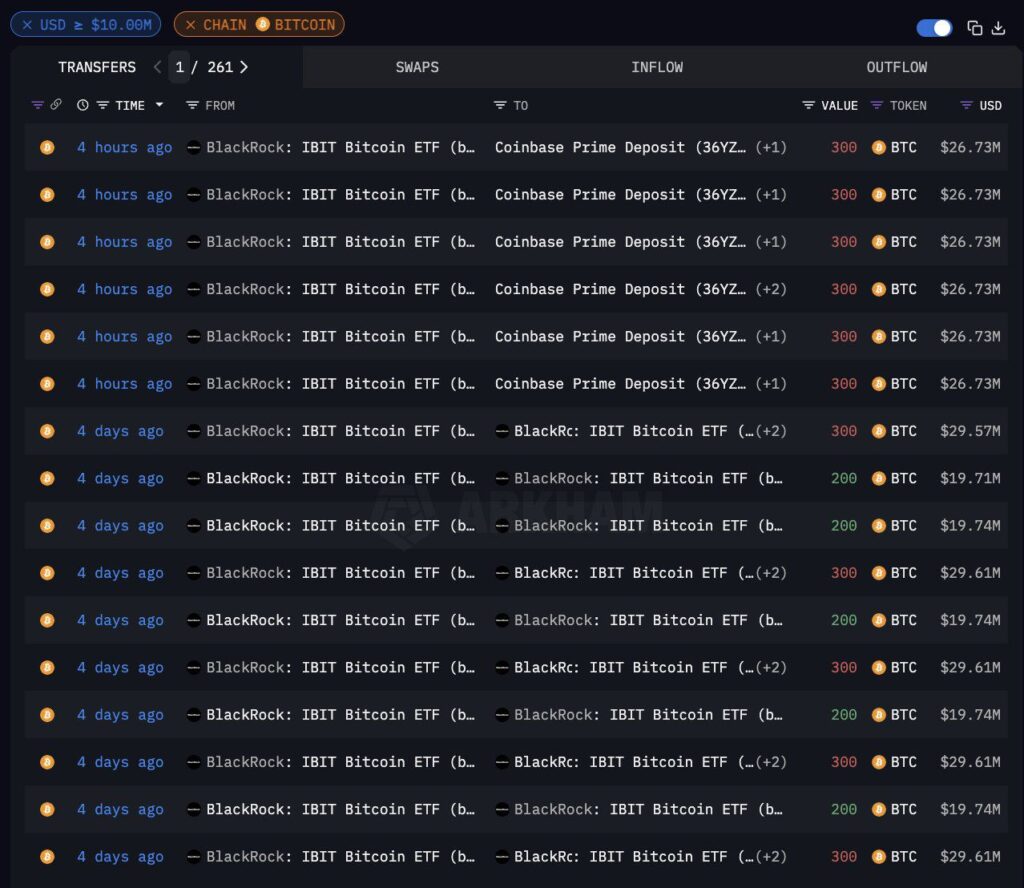

The transfer, detailed in visuals shared by Arkham, shows a series of transactions involving 300 BTC each, totaling $150 million, executed just hours before the alert was posted. This activity follows a larger pattern of BlackRock moving significant cryptocurrency assets to Coinbase, including $204 million in Bitcoin and Ethereum earlier in the day, as reported across social media and crypto tracking platforms. The moves have been interpreted by some as a potential sell-off, raising concerns of bearish sentiment in an already volatile market.

BlackRock’s IBIT ETF, launched in January 2024, has solidified its position as the world’s largest Bitcoin ETF, boasting over $56.8 billion in assets under management and commanding a 50.4% market share among U.S. spot Bitcoin ETFs, according to recent data. However, the recent outflows—part of a trend that saw $500 million exit Bitcoin ETFs collectively on February 24—suggest a shift in investor confidence or strategic portfolio adjustments by the asset management giant.

Crypto enthusiasts and analysts on X expressed a mix of alarm and intrigue. Posts from accounts like @MartiniGuyYT and @pete_rizzo_ labeled the transfer a “sell signal,” with some warning of impending price drops for Bitcoin, which recently fell to $86,000—its lowest in over three months. Others, however, speculated that BlackRock might be repositioning assets for future investments or managing client redemptions, given the firm’s history of using over-the-counter (OTC) markets for large crypto trades.

“The highly respected @arkham reports that even @BlackRock is allegedly selling. Don’t be fooled!

As far as we can see, Coinbase Prime is just a custodian for BlackRock’s $IBIT ETF—these transfers are normal and have been happening for months. BlackRock and other institutions aren’t exiting, they’re presumably buying the ₿ dip. We don’t see sells atm,” noted a crypto analyst on X.

Pointing to the firm’s long-standing partnership with Coinbase, which provides custody and trading services for IBIT. The partnership, established in 2022, integrates BlackRock’s institutional clients with Coinbase’s infrastructure, but the public nature of these transfers has caught the market off guard.

Bitcoin’s price, currently hovering around $98,000, has faced pressure amid global economic uncertainties and high-profile crypto events, including the recent Bybit exchange hack—the largest in history. Meanwhile, Ethereum, also part of BlackRock’s recent transfers, has seen similar volatility, with the firm moving 18,168 ETH ($43.6 million) to Coinbase Prime, further fueling speculation about a broader sell-off strategy.

BlackRock has not yet commented on the specific purpose of these transactions, leaving the crypto community divided. Some view the moves as a tactical response to maintain liquidity for ETF redemptions, while others see it as a signal of waning institutional confidence in Bitcoin’s short-term prospects.

“Everyone wants to buy Bitcoin cheap, and BlackRock might be positioning to acquire more at a lower price,” suggested Wise Advice, a prominent Asian crypto influencer, on X.

As the market digests these developments, analysts remain cautious. Bitcoin’s trajectory in 2025, with predictions ranging from $180,000 to new highs, hinges on factors like institutional adoption, regulatory clarity, and macroeconomic trends. For now, BlackRock’s actions are a focal point, with investors closely watching whether these transfers mark the beginning of a bearish trend or a strategic pivot in the world’s largest asset manager’s crypto playbook.

Bitcoin Price Faces Downtrend but Finds Support at Key Level

Bitcoin (BTC) experienced a sharp downtrend, dipping below $86,000 on February 25, its lowest in over three months, amid heightened market volatility and significant outflows from major ETFs like BlackRock’s IBIT. The sell-off, triggered by institutional transfers totaling $204 million to Coinbase Prime and profit-taking by short-term holders, raised concerns among investors. However, BTC found strong support around the $85,000 level, a critical psychological and technical threshold, stabilizing at approximately $98,000 by early Wednesday. Analysts attribute the recovery to long-term hodlers accumulating 580,000 BTC over the past month and a resilient demand base, signaling potential for a rebound if macroeconomic conditions and institutional confidence stabilize.

Join our Telegram Channel

Join our Telegram Channel