In a significant blow to the cryptocurrency industry, Bybit, a leading exchange, has fallen victim to a massive security breach, resulting in the theft of $1.4 billion worth of Ethereum (ETH). The incident, occurring on February 21, 2025, has sent shockwaves through the crypto community, raising serious concerns about the security of digital assets on centralized platforms.

Details of the Hack

Bybit CEO Ben Zhou confirmed that the exchange’s Ethereum cold wallet—a secure offline storage system—was compromised due to a sophisticated attack. The hackers deceived the team into authorizing a malicious transaction by masking it as legitimate. Zhou explained that the attackers misled the wallet’s signers into approving changes to the smart contract managing Bybit’s ETH cold wallet, granting them unauthorized access.

Once in control, the hackers transferred all Ethereum from the cold wallet to an unidentified address. On-chain intelligence firm Arkham reported that over $1.4 billion in ETH and stETH (staked Ethereum) was withdrawn.

The stolen funds were then swapped for other Ethereum-based tokens on decentralized exchanges, complicating efforts to trace and recover the assets, as noted by crypto investigator ZachXBT. This attack is believed to be the largest exploit against a single crypto exchange, accounting for over 50% of the total crypto value stolen in 2024.

Bybit’s Response

Bybit has reassured users that the breach was isolated to the Ethereum cold wallet and that all other cold wallets remain secure. The exchange emphasized its solvency, stating it can cover the loss even if the stolen funds are not recovered.

“All client assets are backed 1-to-1, and withdrawals are proceeding normally,” Zhou said in a statement. Bybit is collaborating with cybersecurity experts and law enforcement to investigate the incident and track down the perpetrators while implementing enhanced security measures to prevent future attacks.

Impact on the Cryptocurrency Market

The hack triggered immediate market turbulence, with Bitcoin (BTC), Ethereum, and other major cryptocurrencies experiencing sharp declines.

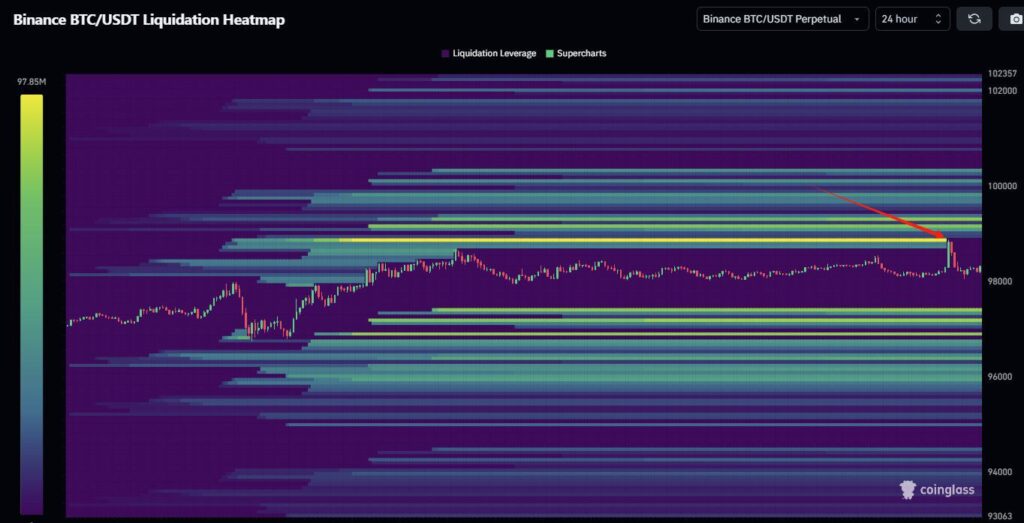

Data from CoinGlass shows over $1.17 billion in liquidations across the crypto market within 24 hours. Ethereum fell nearly 3% to $2,727, while Bitcoin dipped by nearly 1% to $98,091. The total crypto market capitalization dropped by $70 billion in less than half an hour following the announcement.

The incident has reignited debates about the security of centralized exchanges. “Crypto exchanges need to prioritize security and implement robust measures to protect users’ funds,” said Jane Doe, a cybersecurity expert. “The Bybit hack highlights the ongoing threats faced by the industry and the need for greater vigilance.” Industry experts are calling for stricter security standards and increased transparency to safeguard user assets.

Protecting Your Digital Assets

In light of the hack, users are advised to take precautions to secure their cryptocurrency holdings. Consider using hardware wallets for offline storage, enabling two-factor authentication (2FA) on all accounts, and remaining vigilant against phishing attempts. While the crypto industry has made strides in improving security—such as adopting multi-signature wallets and cold storage—incidents like this underscore the persistent risks.

Conclusion

The Bybit hack serves as a stark reminder of the vulnerabilities within the cryptocurrency landscape. As the market continues to grow, exchanges and users alike must prioritize security to mitigate potential threats. Bybit’s response will be closely watched, as it will reflect the exchange’s commitment to its users and their trust in the platform.

Join our Telegram Channel

Join our Telegram Channel