Around $113 million in crypto futures were liquidated in a single hour and $324 million over 24 hours, as nearly $4.5 billion in Bitcoin and Ethereum options expired on December 12, 2025.

Futures Liquidations Spike Around Options Expiry

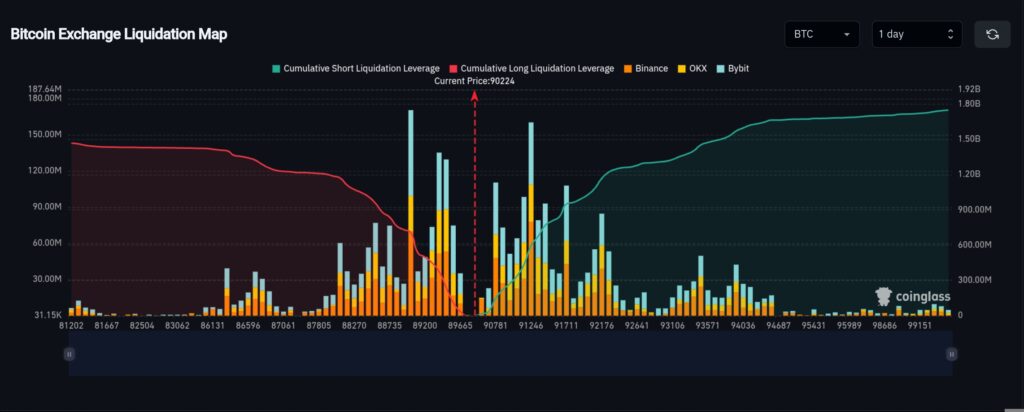

Roughly $113 million worth of crypto futures positions were forcibly closed across major exchanges within a single hour in the last day, according to data reported by BitcoinWorld and CryptoRank using derivatives analytics platforms such as Coinglass. Over the broader 24‑hour window, total crypto futures liquidations climbed to about $324 million, underscoring elevated stress in the derivatives market.

The liquidation wave followed a crowded options-expiry window, after nearly $4.5 billion in Bitcoin (BTC) and Ethereum (ETH) options contracts expired at 8:00 UTC on Dec. 12, 2025, led by activity on Deribit. Market commentators noted that the event occurred against a backdrop of cautious sentiment, thin year‑end liquidity and recent macro developments, including a Federal Reserve interest‑rate cut.

High-Pressure Conditions Converge

Options data show that the expiring BTC and ETH contracts represent several billion dollars in notional open interest, concentrating hedging and speculative flows into a narrow time window. Analysts have highlighted that such large expiries can amplify short‑term volatility when combined with already reduced order‑book depth late in the year.

The $113 million in one‑hour liquidations reflects forced closures of leveraged futures positions when trader collateral fell below exchange maintenance margin thresholds. According to the BitcoinWorld analysis, many positions employed high leverage, meaning relatively modest price swings were sufficient to trigger margin calls and subsequent automatic liquidations.

Mechanics and Market Structure Impact

Futures liquidations occur when exchanges close a trader’s position to prevent losses exceeding posted collateral, a process that can accelerate price moves when concentrated in a short period. Data providers noted that the latest wave affected both long and short positions, although periods of sharp directional movement typically see heavier losses on the side positioned against the move.

Analytics platforms such as Coinglass aggregate real‑time liquidation data across major venues including Binance, Bybit, OKX and others, allowing market participants to track where leverage is building and unwinding. Recent history shows that multi‑hundred‑million‑dollar liquidation clusters, while not unprecedented, often coincide with key macro events or major derivatives expiries, similar to the current setup.

Implications for Traders, Builders and Institutions

For retail and professional traders, the event reinforces the risk profile of high‑leverage strategies, particularly around known catalysts such as large BTC and ETH options expiries. Risk professionals continue to emphasize lower leverage, tighter position sizing and the use of stop‑loss orders and additional margin buffers when volatility and derivatives open interest are elevated.

For exchanges and protocol builders, concentration of liquidations in short bursts highlights the importance of robust liquidation engines, insurance funds and circuit‑breaker mechanisms to limit contagion from stressed positions into broader market liquidity. For institutions and potential regulators, the combination of multi‑billion‑dollar options expiries and nine‑figure liquidation events provides further evidence that crypto derivatives remain a key transmission channel for volatility across the digital asset ecosystem.

Join our Telegram Channel

Join our Telegram Channel