[ad_1]

- Surged retail activity amidst BTC price fluctuations hints at an impending upside.

- BTC’s median transfer volume recently hit record lows.

- Nonetheless, Bitcoin transactions soared to an ATH.

Bitcoin‘s (BTC) fluctuations seem to have triggered dips in institutional investors. Nonetheless, retail market participants have seen opportunities to record surged activity. Let us evaluate the level of involvement that retail and institutional holders might showcase according to the present transaction figures.

BTC median transfer volume at record lows

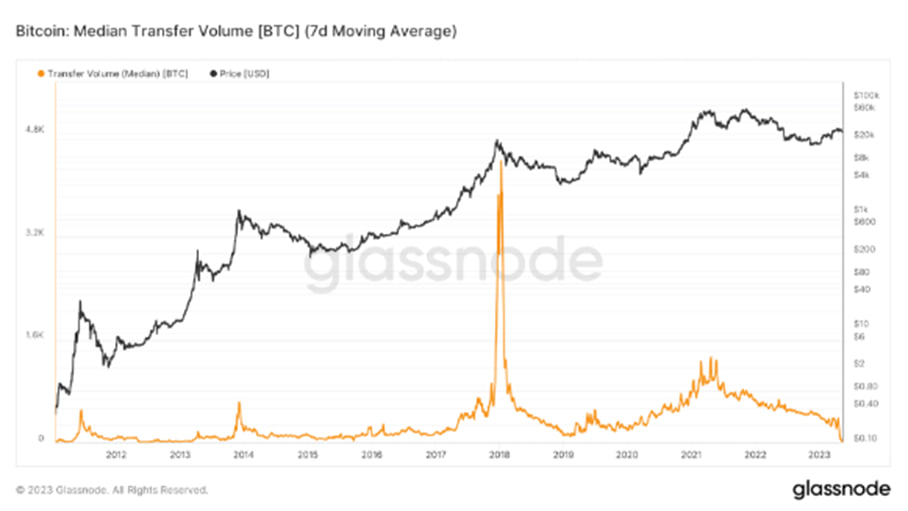

Recently, Glassnode revealed that Bitcoin’s 7D MA Median Transaction Volume hit all-time lows. The observation surfaced in March, and the downtrend has dominated since. While publishing this content, the asset’s median transaction volume swayed at 3.5 BTC. Surprisingly, this zone represented the lowest level in the last five years.

Source – Glassnode

BTC Median Transfer Volume helps in evaluating transaction activity in the Bitcoin blockchain. The metric focuses on analyzing the median transfer value in BTC transactions. Higher median transfer volumes confirm surges in massive transactions, suggesting possible involvement from high-worth or institutional investors. Meanwhile, lower median transaction volume indicates dominant retail participation.

BTC transaction count hits ATH

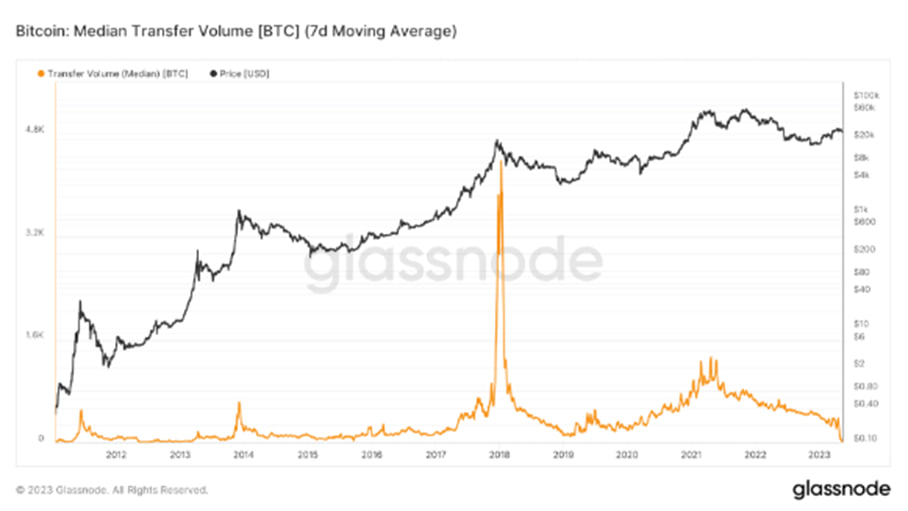

While the Median Transaction numbers highlight a notable dip, the Transaction Count Index showcased an opposite trend. Glassnode’s Transaction Count data indicated that the crypto’s transactions count surged consistently, recently hitting a historical all-time high. While publishing this post, the transaction count stood beyond 631,000 – the highest figure the network has ever recorded.

Source – Glassnode

The uptick in transaction count indicated increased activity by retail investors, as institutional traders have decreased their participation lately. That confirmed that retail participants have been active in the BTC platform, therefore skyrocketing transaction count.

The recovery path?

Bitcoin presented recovery signals on its daily chart following the latest declines. BTC trades beyond $27K at press time, gaining around 1% over the past 24 hours. Meanwhile, that marked the 3rd successive day of BTC’s upside. Nonetheless, the asset’s short Moving Average presented a resistance zone around the $28K value area.

Source – TradingView

Retail investors have showcased their love for the market despite significant volatility. The consistent trading volume revealed their continued involvement. Nonetheless, the emergence of institutional investors will confirm an impressive bull market. That might welcome steady momentum for the bellwether crypto.

Ad

Invest in the top cryptocurrencies quickly & easily with the worlds largest and most trusted broker, eToro.

10/10

77% of retail CFD accounts lose money

[ad_2]

Join our Telegram Channel

Join our Telegram Channel