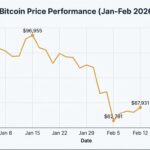

Bitcoin (BTC) experienced a significant surge in value, surpassing the $30,000 mark, driven by the recent ETF applications from financial giants BlackRock and Invesco. The cryptocurrency market has witnessed substantial gains in the wake of this positive development, with Bitcoin leading the charge. This surge in price has attracted the attention of investors and traders alike, as they navigate the evolving landscape of digital assets.

Bitcoin’s Price Momentum and Market Analysis

Bitcoin, currently trading at $30,330.0 on Binance, has seen a remarkable increase of $1,548.0 (+5.38%) compared to its previous close [1]. The trading volume for Bitcoin in the past 24 hours reached 100,983 BTC, indicating strong market activity.

The day’s trading range for Bitcoin spans from $28,770.9 to $30,800.0 [1]. These figures demonstrate the cryptocurrency‘s volatility and the potential for lucrative trading opportunities.

Technical indicators suggest the likelihood of a price correction in the near future due to overbought conditions. The 14-day Relative Strength Index (RSI) stands at 69.382, nearing the overbought threshold.

Additionally, the Stochastic Oscillator (STOCH) reading of 98.221 and the Williams %R value of -2.489 also indicate overbought conditions.

However, the Moving Average Convergence Divergence (MACD) at 504.200 and the Average Directional Index (ADX) at 51.784 suggest a bullish trend and potential price increase [1].

Impact on Short Traders and Liquidations

The surge in Bitcoin’s price to $30,000 has had a significant impact on short traders, resulting in the largest single-day losses since April.

Over $178 million worth of bets against crypto tokens were liquidated within a 24-hour period, with Bitcoin futures alone accounting for $75 million in losses.

This rapid liquidation of short positions demonstrates the risks associated with betting against rising prices in the cryptocurrency market.

Institutional Interest and Investor Sentiment

The recent ETF filings by BlackRock and Invesco have further fueled the bullish sentiment in the cryptocurrency market. The prospect of increased institutional involvement has attracted the attention of professional investors managing almost $5 trillion in assets.

A survey conducted by Laser Digital, a digital assets subsidiary of Nomura, revealed that 96% of these investors expressed a keen interest in investing in cryptocurrencies.

The study emphasized the potential benefits of digital assets, such as portfolio diversification, as cited by Laser Digital CEO Jez Mohideen [3].

Future Outlook and Regulatory Considerations

The surge in Bitcoin’s price and the growing interest from institutional investors indicate a shifting trend towards Bitcoin as a robust store of value.

Industry experts anticipate this trend to continue, especially if ETF applications from prominent financial institutions, including BlackRock and Fidelity, receive regulatory approval in the coming months.

The potential acceptance of Bitcoin-based products by traditional finance giants reflects a broader acceptance and recognition of the cryptocurrency’s long-term value [2].

Conclusion

Bitcoin’s recent surge past $30,000, propelled by BlackRock and Invesco’s ETF applications, has created a wave of optimism in the cryptocurrency market. Technical indicators and market analysis suggest the possibility of a price correction, while short traders faced substantial losses due to rapid liquidations. The interest from institutional investors and the anticipation of regulatory approvals for Bitcoin-based products point towards a positive outlook for the future of cryptocurrencies.

[1] Source: Bitcoin (BTC/USD) Price Analysis Report – 22 June 2023

[2] Source: Bitcoin’s Price Bump to $30K Sees Short Traders Nurse Biggest Loss in 2 Months

[3] Source: ‘A New Wave’—Major Bank Reveals A $15 Trillion Earthquake Could Be Headed for Bitcoin, Ethereum, and Other Cryptocurrencies

Join our Telegram Channel

Join our Telegram Channel