Bitcoin, the world’s first and most popular cryptocurrency, has been on a roller coaster ride since its inception in 2009. From its humble beginnings as a peer-to-peer electronic cash system, Bitcoin has grown to become a global phenomenon, attracting the attention of investors, enthusiasts, regulators, and skeptics alike.

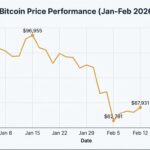

In the past year, Bitcoin has experienced unprecedented highs and lows, reaching a record-breaking price of over $60,000 in March 2021, before plunging to below $30,000 in June 2021. Despite the volatility, many experts and analysts have made bold predictions about Bitcoin’s future, some of them claiming that it could reach six or even seven figures by 2024.

But how realistic are these forecasts?

What are the factors that could drive Bitcoin’s price to such astronomical levels?

And what are the risks and challenges that could prevent it from reaching its full potential? In this blog post, we will examine some of the most prominent Bitcoin price predictions for 2024, and analyze the rationale and evidence behind them.

Bitcoin Price Predictions for 2024: A Snapshot

According to a survey by Finder, a comparison platform for financial products, the average Bitcoin price prediction for 2024 among 31 fintech experts is $87,000. This figure reflects a wide range of opinions, from the optimistic to the cautious, based on various factors such as the impact of the Bitcoin halving, the adoption of Bitcoin ETFs, the macroeconomic environment, and the innovation in the crypto space.

Here are some of the most notable Bitcoin price predictions for 2024 from different sources:

– ARK Invest (Cathie Wood): $600,000 – $1,500,000 by 2030

– Matrixport (Markus Thielen): $125,000 by end of 2024

– BitQuant: $80,000 – $250,000 by end of 2024

– Layer One X (Matiu Rudolph): $340,000 by 2025

– Bloomberg Intelligence (Mike McGlone): $100,000 by 2026

– Morgan Stanley (Denny Galindo): Not specified, but new bull run after the fourth halving

– Bernstein (Gautam Chhugani): $150,000 by 2025

As you can see, there is a lot of variation and uncertainty in these predictions, which highlights the inherent complexity and unpredictability of the cryptocurrency market. However, there are some common themes and arguments that emerge from these forecasts, which we will explore in the next sections.

The Bitcoin Halving: A Catalyst for Growth

One of the most frequently cited factors that could influence Bitcoin’s price in 2024 is the Bitcoin halving, a pre-programmed event that occurs every four years, and reduces the supply of new bitcoins by 50%. The next halving is expected to take place in April 2024, and will reduce the block reward from 6.25 bitcoins to 3.125 bitcoins per block.

The Bitcoin halving is based on the principle of supply and demand: as the supply of new bitcoins decreases, the demand for existing bitcoins increases, which drives up the price. This is what happened in the past three halvings, which occurred in 2012, 2016, and 2020, and were followed by significant price increases in the subsequent months and years.

For example, after the first halving in 2012, which reduced the block reward from 50 bitcoins to 25 bitcoins, the price of Bitcoin increased from around $12 to over $1,000 in 2013, a staggering 8,233% increase.

Similarly, after the second halving in 2016, which reduced the block reward from 25 bitcoins to 12.5 bitcoins, the price of Bitcoin increased from around $650 to nearly $20,000 in 2017, a 2,977% increase.

And after the third halving in 2020, which reduced the block reward from 12.5 bitcoins to 6.25 bitcoins, the price of Bitcoin increased from around $8,500 to over $60,000 in 2021, a 606% increase.

Based on this historical pattern, many analysts expect the fourth halving in 2024 to trigger another bull run for Bitcoin, potentially pushing its price to new heights.

For instance, Denny Galindo, a research analyst at Morgan Stanley, believes that the halving will create a supply shock that will boost Bitcoin’s value proposition as a scarce and deflationary asset. He predicts that Bitcoin will enter a new cycle of growth after the halving, similar to the previous ones, and that it will outperform other asset classes in the long term.

However, not everyone agrees that the halving will have such a positive impact on Bitcoin’s price. Some skeptics argue that the halving is already priced in by the market, and that it will not have a significant effect on the supply and demand dynamics.

They point out that the halving is a predictable and transparent event, and that the market has already adjusted to the reduced inflation rate of Bitcoin. They also note that the halving could have negative consequences for the security and profitability of the Bitcoin network, as it could reduce the incentives for miners to validate transactions and secure the network.

For example, Mike McGlone, a senior commodity strategist at Bloomberg Intelligence, believes that the halving will have a diminishing effect on Bitcoin’s price, as the supply reduction becomes less significant over time. He argues that the halving will not be a major catalyst for Bitcoin’s growth, and that other factors, such as institutional adoption, innovation, and regulation, will have a bigger influence on Bitcoin’s price in the future.

Bitcoin ETFs: A Paradigm Shift in 2024

In 2024, the approval of Bitcoin exchange-traded funds (ETFs) could revolutionize the landscape of Bitcoin adoption. ETFs, acting as investment vehicles, could simplify access to Bitcoin for investors, sidestepping technical intricacies and security challenges associated with direct Bitcoin acquisition and storage.

The potential impact extends beyond accessibility, with Bitcoin ETFs poised to enhance liquidity and legitimacy. Attracting institutional and retail investors, media attention, and regulatory oversight could contribute to stabilizing Bitcoin’s volatility and risk. Despite this potential, the absence of Bitcoin ETFs in the influential U.S. market remains a significant hurdle, as the Securities and Exchange Commission (SEC) has expressed concerns about market manipulation, fraud, custody, and investor protection.

Despite regulatory challenges, optimism persists within the crypto community. Advocates highlight successes in other countries, and with a new SEC chairman, Gary Gensler, who is a crypto expert, prospects for U.S. approval appear more favorable.

Markus Thielen of Matrixport anticipates a game-changing scenario, predicting a significant capital influx into Bitcoin if a U.S. Bitcoin ETF gains approval. His estimation suggests a potential $50,000 addition to Bitcoin’s price by the end of 2024, reaching $125,000.

However, not all voices echo this positive sentiment. Critics argue that Bitcoin ETFs could compromise decentralization and innovation, potentially diverting attention from the underlying technology. Matiu Rudolph, CEO of Layer One X, warns against the disconnect between Bitcoin’s price and value, emphasizing the importance of focusing on fundamentals and the long-term vision rather than short-term fluctuations.

The narrative takes a significant turn with the SEC’s approval of 11 spot Bitcoin ETFs for trading in the U.S. on January 10, 2024. This milestone decision could simplify and broaden Bitcoin investment for mainstream investors, but the SEC’s cautionary stance underscores the inherent risks associated with Bitcoin.

Macroeconomic Environment: A Mixed Bag for Bitcoin

A third factor that could affect Bitcoin’s price in 2024 is the macroeconomic environment, which refers to the overall conditions and trends of the global economy, such as growth, inflation, interest rates, trade, and geopolitics.

The macroeconomic environment could have a significant impact on Bitcoin, as it could influence the supply and demand of money, the risk appetite of investors, and the regulatory stance of governments.

The macroeconomic environment in 2024 could be a mixed bag for Bitcoin, as it could present.

Conclusion: Navigating Uncertainty with Informed Decisions

As we navigate the unpredictable journey toward Bitcoin’s potential $100,000 milestone, it’s essential to remain vigilant. The road is marked by varying predictions, regulatory milestones, and macroeconomic shifts. Whether you’re a seasoned investor or a curious onlooker, understanding the diverse factors influencing Bitcoin’s price is key to making informed decisions.

In the ever-evolving world of cryptocurrency, one thing remains certain—Bitcoin’s journey is a roller coaster, and the ride to $100,000 is a captivating spectacle.

Disclaimer: This is not financial advice, and you should always consult with a qualified financial professional before making any investment decisions.

Join our Telegram Channel

Join our Telegram Channel