The world has been full of bad news recently, so it’s refreshing to be reporting on something positive.

This morning, arguably the single biggest event in the short history of cryptocurrency took place. Ethereum “merged”, completing its upgrade to a Proof-of-Stake (PoS) blockchain. And it was 100% successful.

In this piece, I’ll dig into what it all means, how it transpired and the price action in the wake of the big event. And why not throw in some predictions right at the end?

Why has the Merge occurred?

Shifting away from the energy-intensive “mining” that Bitcoin uses, the upgrade is primed to reduce Ethereum’s energy consumption by 99.95%. This is one of, if not the biggest, complaint about crypto in general – its outsized carbon footprint. No matter what way you swing it, the upgrade to Proof-of-Stake now renders this point nearly moot.

“The merge will reduce worldwide electricity consumption by 0.2%” – @drakefjustin

Also Read— vitalik.eth (@VitalikButerin) September 15, 2022

Overall, Ethereum is responsible for between 20% and 39% of cryptocurrency’s energy usage. Wiping this out is a nice win at a time when every time we turn on our TV’s, we see another climate disaster, terrifying statistic or other scary sign that our planet is crumbling.

In the long-term, it is also hoped that the network will be more scalable. The prime hope for this is through sharding, which essentially splits the blockchain of the entire network into smaller partitions known as “shards”. The details beyond that are beyond the scope of this piece – I don’t want this turning into a novel – but I’ll do a deep dive in future on this and link it here once done.

Ethereum Supply

The other intriguing development here is the supply. There is perhaps no more seductive word in cryptocurrency than “deflationary”, and since Vitalik invented Ethereum in 2015, the supply has been increasing.

While it is too early to say that it will no longer be inflationary, the rate of inflation will certainly slow, at least.

The amount of ETH issued for each block will drop between 85% and 90%, according to Lucas Outumoro of IntoTheBlock, as a result of the merge. Intriguingly, this is equivalent to about three Bitcoin Halvenings occurring overnight (a Halvening is the phenomenon which occurs in Bitcoin every 4 years, where the block reward is halved).

Ethereum’s supply, as I write this, is down 191 ETH since the Merge. That’s very cool.

However, it should be mentioned that speculation, transaction volume and fees are high in the immediate aftermath of the Merge, and hence more ETH is being burned as a result – this supply decline is therefore likely overegged compared to what will happen in future.

Outumoro further estimates that ETH will end up slightly inflationary post-Merge, although less than the current 3.5%. The graph below is a neat indicator of his latest estimates – not quite deflationary, but well below historical levels.

This opens up all kinds of different price effects. And this applies not only to ETH, but to the industry as a whole. I wrote last month about one theory I have regarding the potential for the staking yield on Ethereum to create a risk-free yield for all of DeFi. This is one such potential outcome, but the price action and correlation with the wider market will be fascinating to track going forward.

Decentralisation and security

A lot has been made of the impact on decentralisation. PoS, by definition, rewards those holding more tokens with a greater yield, thereby leading to them holding an even greater amount of tokens. It’s easy to see how that is worrisome.

Advocates will argue that the increased inaccessibility of mining, on the other hand, renders Proof-of-Work more centralised than previously. While they have a point – the bulk of mining is now conducted by specialty firms and the days of mining Bitcoin on your personal laptop in your college dorm are long gone – it misses the bigger picture.

Proof-of-work is far from perfect, but in terms of creating “hard money”, it’s about as close as is possible. Security is vital if an uncensored, unhackable, unalterable form of money is to catch on, and this move to PoS increases the potential for the doomsday scenario: a 51% majority attack.

Let me explain. To be a validator on Ethereum post-Merge, you need to post 32 ETH. This is a large chunk of change – over $50,000 at time of writing – meaning it is not possible for the everyday user. That’s where staking pools come in, where users contribute to a pool and earn rewards pro-rata.

The problem is that a lot of these proof-of-stake validators can be easily regulated and, in this doomsday scenario, even censored. This is not far-fetched speculation; it has happened before.

Tornado Cash, the controversial “mixer” which runs on Ethereum, allowing users to obfuscate the origin and destination of on-chain transactions (thus enhancing privacy but also facilitating money laundering) was added to the list of restricted entities by the office of Foreign Assets Control (OFAC), which is a financial enforcement agency of the U.S. Treasury Department. In other words, not the guys you want to mess with.

While many blindly preached “decentralisation” as censorship-resistant, the debacle proved that this was naïve. While decentralised applications like Tornado indeed cannot be directly shut down – it’s just a piece of code operating on the Ethereum blockchain, after all – any centralised entities interacting with it can be.

In quick order, the Tornado website crashed, the Github source code was removed, centralised node infrastructure providers Infura and Alchemy (powering much of Ethereum on-boarding, including Metamask) blacklisted Tornado and centralised stablecoin providers like Circle disabled wallet addresses.

Additionally, even DeFi protocols like Aave and Uniswap disabled their front end to any sanction-related wallet addresses (while the protocols overall are decentralised, their front-ends are centralised web services).

How this relates to the staking pools is that they run via centralised, and hence censorship-prone, validators. My Ethereum is staked on Binance. Other popular providers are Coinbase (a public company), Huobi, Bitstamp and on and on.

In fact, over two thirds of validators are required to adhere to OFAC. That’s a big number. And you know what happens when 51% of a network is seized control? Yep – it is prone to a malevolent attack. So we are at a point where by definition, the US government could regulate, censor or control the entire Ethereum blockchain.

Remember that quote by Vitalik himself about centralised stablecoin providers exerting a “significant” impact on the future direction of Ethereum? Is it too hard to imagine in this context that the US government could do the same?

Positives

Like I said, this is the doomsday scenario. Overall, the Merge is an incredibly bullish development for Ethereum, and I’m on record over the years saying it is the direction the network needs to take. But it does highlight the contrast between Bitcoin, the PoW blockchain aiming to become a store-of-value and impenetrable, hard money. And it’s important to be objective here and analyse all outcomes.

Ethereum required a solution for scaling and this will help it facilitate those efforts in future. Secondly, its vision is different than Bitcoin and its consumption of vast amounts of energy is harder to justify in this respect.

Ethereum is aiming to become the building block for decentralised finance and the pipeline through which Web3 and all the other myriad crypto functions will operate. While the security will be comprised, life is about trade-offs, and the benefits here outweigh the negatives.

Price action

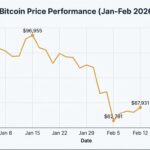

There was a lot of eyes on the price as the Merge approached, and it kind of did nothing. But that’s actually a great thing. Much of the Merge had been priced in already, so it proceeding right on cue was reflected in the price, which largely followed the wider market in what has been a pretty understated morning thus far.

This is similar to what we saw from Bitcoin, and indeed the stock market, this morning. Hey, after the shellshock that was yet another jarring inflation reading earlier this week, investors won’t complain.

Next we look at the funding rate, which is quite interesting. To the uninitiated, a negative funding rate means there are a greater number of short sellers in the derivative market than longs. A positive funding rate, on the other hand, means there are a greater number of longs. So traditionally, positive funding rates are seen during bull runs and negative during bear runs.

I have seen a little kerfuffle this month in the run up to the merge, as the funding rate on Ethereum has turned sharply negative, as the graph below shows. In fact, it is at all-time lows.

This makes sense when you think about it, however. Spot exposure to Ethereum likely will net the holder the ETH PoW token, which will be airdropped shortly. While I have been critical of ETH PoW – I pretty much view it as a waste of time – it could carry value and investors are betting on this by striving to get their hands on ETH. Because holders of ETH will therefore receive this value, there is an added incentive to hold into the Merge.

And so, longing spot and shorting the futures must cost more than normal. Otherwise, there would be an arbitrage opportunity and the market would be inefficient. You could long spot ETH, short ETH futures and receive the ETH PoW token for free.

Bitfinex shows us the price action of this PoW token, as it has offered a futures contract on the PoW token. Climbing as high as $60 in late August, it has since fallen – but the value (now at $24) displays the reason for the more negative funding rate.

Price action going forward

Sorry if you read this far hoping for a crystal ball, but I have no insights here. The Merge has been successful and that is hugely bullish long-term. However, in the short to medium term, we are still living in a world that is facing a unique set of challenges – inflation, energy crises, mass unrest, geopolitical catastrophe and many other unpredictable variables.

The CPI print of this week shows that macro is leading crypto markets right now, and will continue to do so for the foreseeable. It is a subject I have spent countless hours writing about recently – most recently here, when I bought a bunch of stocks despite being bearish and very uncertain – and the environment will continue to be turbulent going forward.

Crypto is about as far out on the risk spectrum as you can get. Accordingly, it will move drastically in the short term and nobody knows where it will go.

But make no mistake, this is an absolutely momentous moment in the history of cryptocurrency. The Merge has finally taken place, and it occurred smoothly without a glitch.

It’s an incredible achievement. Well done to all involved.

The post What does the Ethereum Merge mean? A post-merge analysis appeared first on Invezz.

from Cryptocurrency – Invezz

Join our Telegram Channel

Join our Telegram Channel