Ethereum’s largest holders made waves Tuesday, shifting over $132 million in the cryptocurrency across privacy tools, loan repayments and exchange withdrawals. These moves, tracked on the blockchain, come as ETH hovers near $3,200 amid broader crypto volatility.

In a snapshot of whale activity, three standout transactions highlighted the network’s high-stakes undercurrents: a founder’s privacy play, a leveraged bet’s closeout and a firm’s strategic pullback.

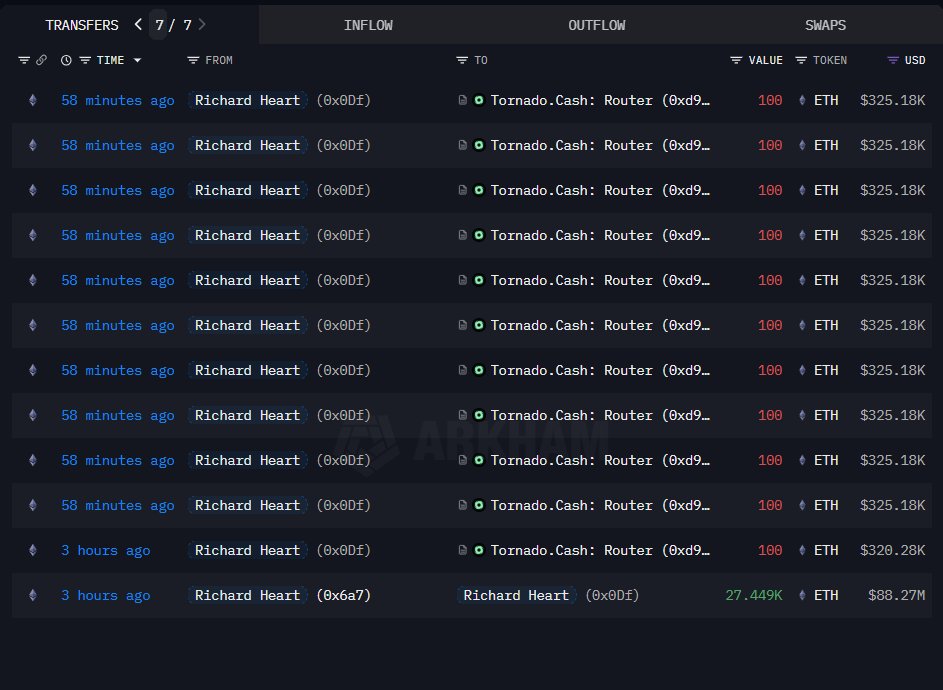

Richard Heart’s $88M ETH Shuffle Raises Eyebrows

Richard Heart, the founder of HEX facing U.S. Securities and Exchange Commission fraud charges since 2023, transferred 27,449 ETH—valued at about $88.2 million—to a fresh wallet on Nov. 4. The assets then funneled through Tornado Cash, a mixing service designed to obscure transaction trails.

This batching step aligns with Heart’s history of on-chain maneuvers during legal scrutiny. On-chain analytics from verified X account OnchainLens flagged the activity as a potential privacy pivot.

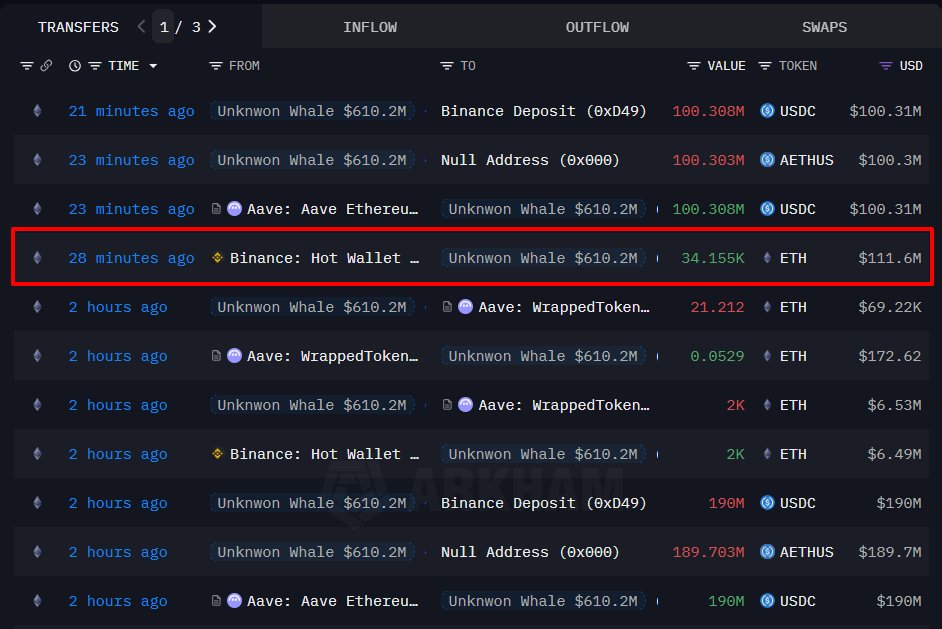

Whale Closes $610M Aave Position for $20M Gain

A deep-pocketed trader unwound a massive position on decentralized lending platform Aave the same day, repaying a 66,000 ETH loan backed by $610 million in collateral. The move followed a short position on Binance during a recent ETH price dip.

Post-repayment, the whale withdrew 34,155 ETH, worth roughly $111.6 million, pocketing an estimated $20 million profit. Such liquidations underscore Aave’s role in leveraged DeFi plays, per the OnchainLens breakdown.

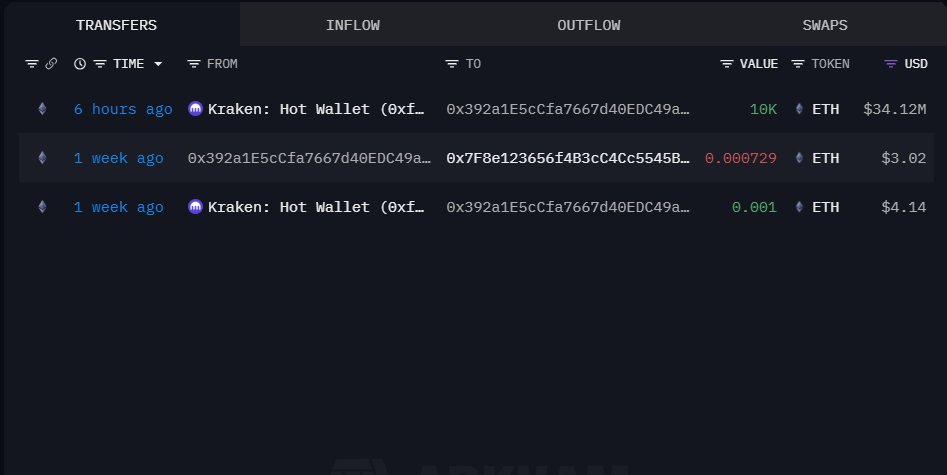

BitMine Immersion Pulls $32M from Kraken

Publicly traded BitMine Immersion Technologies withdrew 10,000 ETH—around $32.7 million—from Kraken exchange on Nov. 4. The pull aligns with the firm’s recent filing disclosing 3.4 million ETH holdings within a $13.7 million crypto portfolio.

This accumulation strategy positions BitMine as a corporate ETH accumulator. Blockchain trackers via OnchainLens noted the transfer as part of ongoing treasury builds.

These transactions reflect Ethereum‘s enduring appeal to institutions and individuals navigating regulatory and market pressures. As whales reposition, watch for ripple effects on liquidity and price floors in the weeks ahead.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risk, and readers should conduct their own research and consult with financial professionals before making investment decisions.

Join our Telegram Channel

Join our Telegram Channel