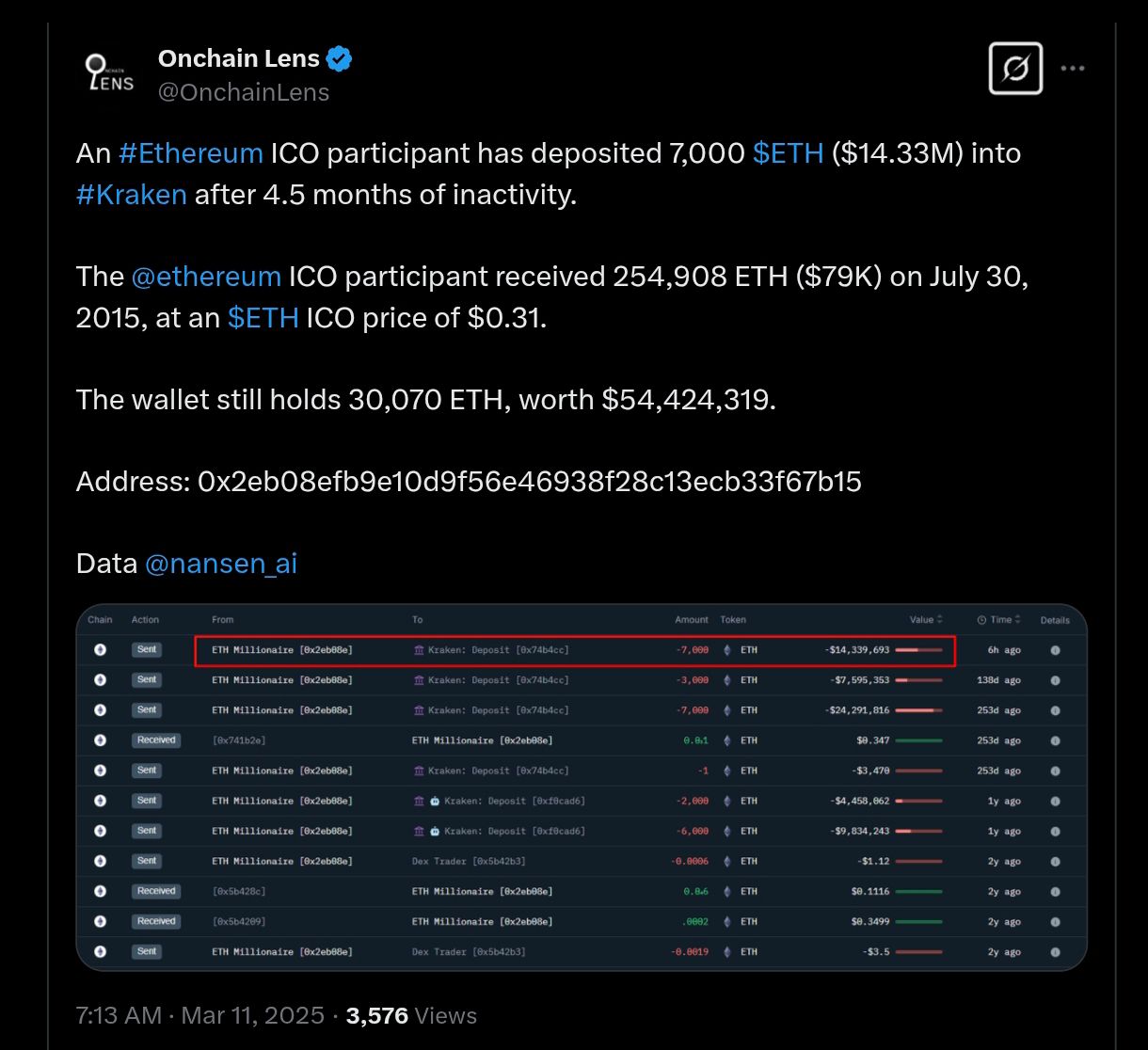

In a move that’s sending ripples through the cryptocurrency community, an early Ethereum investor from the 2015 Initial Coin Offering (ICO) has deposited a staggering 7,000 ETH, valued at approximately $14.3 million, into the popular crypto exchange Kraken. This activity, reported by on-chain analytics platform Nansen.ai and shared by Onchain Lens on X on March 11, 2025, marks the end of a 4.5-month period of inactivity for the wallet, sparking intense speculation among traders and enthusiasts alike.

The wallet in question, identified by the address 0x2eb08efb9e10d9f56e46938f28c13ecb33f67b15, originally received 254,908 ETH during Ethereum’s ICO on July 30, 2015. At the time, each ETH was priced at just $0.31, meaning the initial investment was worth a modest $79,000. Fast forward to today, and the value of Ethereum has skyrocketed, transforming that early stake into a fortune. The wallet still holds 30,070 ETH, currently valued at around $54.4 million, underscoring the massive growth of Ethereum since its inception—a testament to its evolution into one of the world’s leading blockchain platforms.

So, what does this deposit to Kraken mean? For crypto watchers, such moves by whales—large holders of digital assets—often signal potential selling activity. The 7,000 ETH deposit, equivalent to roughly 23% of the wallet’s remaining holdings, could indicate that the investor is looking to cash out part of their gains, especially given Ethereum’s price volatility and the broader market’s ups and downs. However, there’s another possibility: the investor might be using Kraken as an intermediary to shuffle funds to other platforms for purposes like staking or diversifying their portfolio. In Ethereum’s current proof-of-stake system, locking up ETH for staking can yield annual rewards, particularly for wallets holding at least 32 ETH.

Kraken, a U.S.-based cryptocurrency exchange founded in 2011, is no stranger to high-profile transactions. Known for supporting over 185 cryptocurrencies and offering advanced trading tools via its mobile apps, Kraken has become a go-to platform for both retail and institutional investors. The exchange’s reputation for security and liquidity makes it an ideal choice for whales looking to execute large trades discreetly. Meanwhile, Nansen.ai, the analytics tool behind this revelation, continues to cement its position as a leader in on-chain data, providing real-time insights that help investors track wallet movements and identify market trends across more than 20 blockchains.

This isn’t the first time an Ethereum ICO participant has made headlines with a significant move. Back in 2023, another early Ethereum whale transferred 6,000 ETH worth $9.96 million to Kraken, prompting similar speculation about potential sales or strategic portfolio adjustments. Such activity highlights the long-term holding behavior of early Ethereum adopters, many of whom have seen their investments grow exponentially since the ICO raised about $18.3 million in Bitcoin—a figure that now pales in comparison to Ethereum’s market cap, which hovers around $400 billion as of early 2025.

For the broader crypto market, this development could have implications. If the whale decides to sell, it might exert downward pressure on Ethereum’s price, especially if other large holders follow suit. On the flip side, if the funds are being repositioned for staking or long-term holding, it could signal confidence in Ethereum’s future, particularly as the network continues to innovate with upgrades like Ethereum 2.0 and scaling solutions. Traders are already buzzing on platforms like X, dissecting the data and debating what’s next for this wallet and Ethereum’s price trajectory.

In conclusion, the recent deposit of 7,000 ETH by an early Ethereum ICO participant into Kraken after 4.5 months of dormancy is a fascinating development that underscores the dynamic nature of the crypto market. Whether this move signals a profit-taking event or a strategic shift, it’s a reminder of the immense value created by Ethereum’s early backers and the ongoing intrigue surrounding whale activity. As the crypto community watches closely, this story could shape Ethereum’s market sentiment in the weeks ahead.

Join our Telegram Channel

Join our Telegram Channel