A prominent Bitcoin holder with 80,009 BTC, valued at $9.46 billion, transferred 16,843 BTC worth approximately $2 billion to Galaxy Digital, a leading crypto financial services firm, in what analysts suggest could signal a significant sell-off.

The transactions, detailed in posts on X by @lookonchain on Tuesday, sparked widespread speculation in the cryptocurrency community.

Galaxy Digital, founded in 2018 by former Goldman Sachs partner Mike Novogratz, has been depositing portions of the Bitcoin into exchanges, including 2,000 BTC ($236 million) to Bybit and Binance, according to the posts. This influx contrasts with recent market narratives of dwindling exchange reserves, potentially easing supply constraints noted in 2024 analyses.

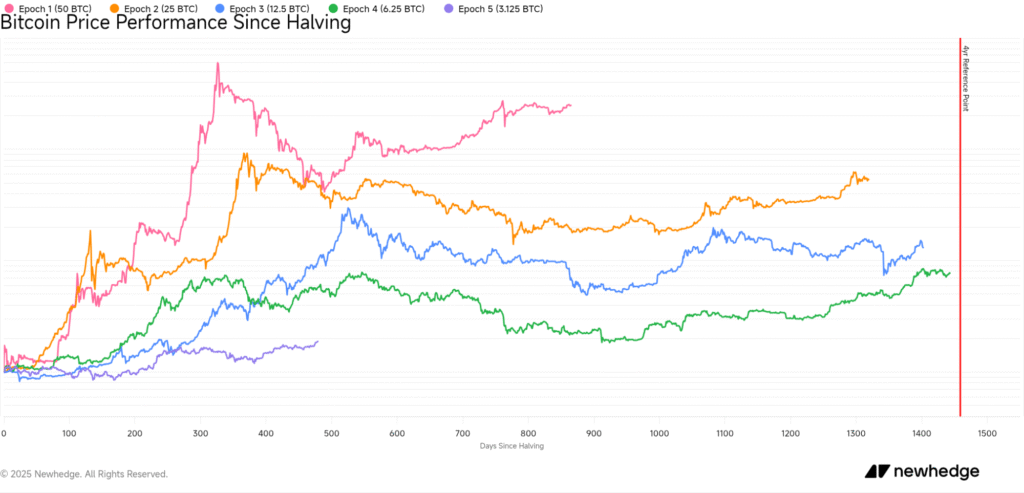

The move comes months after Bitcoin’s April 2024 halving, which reduced block rewards to 3.25 BTC, an event historically linked to price rallies. However, this transfer by an early adopter may indicate a strategy to capitalize on recent price peaks, with Bitcoin reaching $1,23,000 on Coinbase.

Experts suggest this could challenge the long-term “hodling” trend supported by studies highlighting Bitcoin’s price elasticity.

The transactions, tracked via blockchain data shared on X, occurred within hours of each other, with the latest update posted at 3:18 a.m. UTC. The crypto market is closely watching for further developments as the move could influence Bitcoin’s trajectory amid broader adoption and regulatory shifts in 2025.

Join our Telegram Channel

Join our Telegram Channel