CrowdStrike Holdings, Inc. (NASDAQ: CRWD) reported better than expected first fiscal quarter results this month, and the company added 1,620 net new subscription customers during the quarter.

Morgan Stanley has a positive view of the shares of this company, and it reported that CrowdStrike has an attractive valuation which gives it a favorable risk-reward profile in the current market conditions.

Morgan Stanley has a positive view

CrowdStrike Holdings is an American cybersecurity technology company that provides cloud workload and endpoint security, threat intelligence, and cyberattack response services.

CrowdStrike Holdings reported better than expected first-quarter results this month; total revenue has increased by 61.1% Y/Y to $487.83 million, while the first quarter non-GAAP EPS was $0.31 (beats by $0.08).

Total revenue has increased well above the prior guidance, and the company added 1,620 net new subscription customers in the quarter. The total number of subscription customers reached 17,945 as of April 30, 2022, representing a 57% growth year-over-year.

CrowdStrike Holdings updated financial guidance for the second fiscal quarter and for the full 2023 fiscal year. Total revenue for the second fiscal quarter should be between $512 million and $516 million vs. a consensus of $509 billion, while the income from operations should be between $70 million and $73 million.

Total revenue for the full fiscal year should be between $2.19 billion and $2.20 billion vs. a consensus of $2.15 billion, while the income from operations should be between $306 million and $317 million.

Morgan Stanley upgraded shares of CrowdStrike after first-quarter results and reported that it expects continued momentum in the sector and the company’s strong performance in the upcoming quarters.

Hamza Fodderwal, an analyst from Morgan Stanley, assigned a price target of $215 on CrowdStrike shares, which implies a more than 15% upside compared with the current price. Hamza Fodderwal added:

CrowdStrike is the leading beneficiary of growing secular trends within security. Looking ahead, several positive catalysts such as a growing Federal pipeline, new module uptake, and international expansion should drive further estimates upside.

Security remains a top priority as rising cyber threats continue across the globe, and according to Morgan Stanley, CrowdStrike has an attractive valuation which gives it a favorable risk-reward profile in the current market conditions.

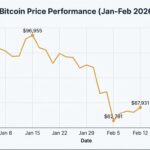

Technical analysis

If the price jumps above $200, it would be a signal to trade shares, and the next target could be resistance at $220.

Rising above $220 supports the continuation of the positive trend for CrowdStrike shares, but if the price falls below $160 support, it would be a strong “sell” signal.

Summary

CrowdStrike Holdings reported better than expected first-quarter results this month, and Morgan Stanley reported that CrowdStrike has a favorable risk-reward profile in the current market conditions. Hamza Fodderwal, an analyst from Morgan Stanley, assigned a price target of $215 on CrowdStrike shares, which implies a more than 15% upside compared with the current price.

The post Should I buy CrowdStrike shares after a positive view from Morgan Stanley? appeared first on Invezz.

from Market Analysis – Invezz

Join our Telegram Channel

Join our Telegram Channel