Tether has frozen an address containing $11 million in USDT linked to phishing activities, marking a crucial moment in the ongoing battle to secure the cryptocurrency ecosystem as of March 14, 2025. This decisive action highlights Tether’s unwavering dedication to tackling illicit transactions in the digital asset world.

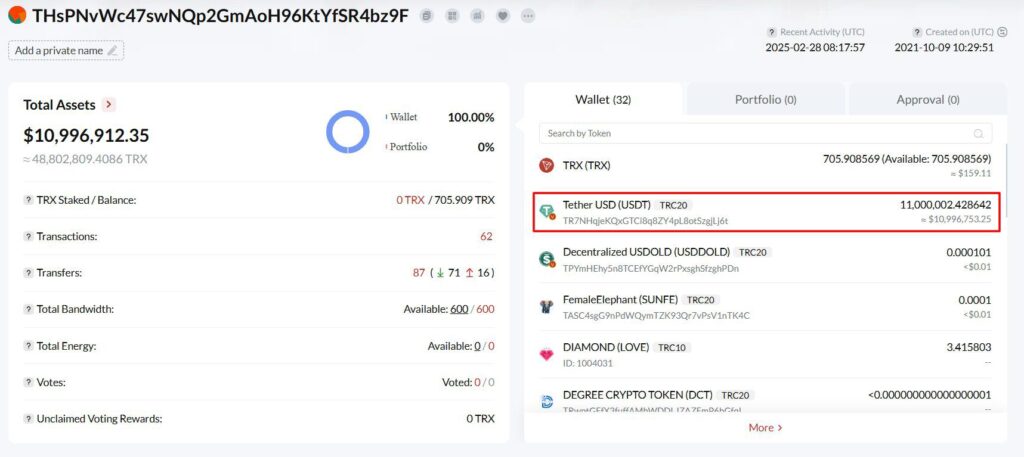

According to Onchain Lens, a trusted blockchain analytics platform, the frozen address—THsPNvWc47swNQp2GmAoH96KtYfSR4bz9F—holds funds connected to fraudulent schemes, as outlined in a post on X at 03:54 UTC on March 14, 2025. Reports suggest this move aligns with Tether’s history of cracking down on suspicious activity, building on its reputation for vigilance in the crypto space.

The investigation, unfolding quickly, shows that Tether identified this address using sophisticated monitoring tools developed in collaboration with Chainalysis, a leading blockchain analytics firm. As confirmed by Cryptobriefing’s coverage from May 2, 2024, this partnership focuses on detecting illicit crypto transfers, including those potentially evading sanctions. What’s more, sources indicate this freeze echoes Tether’s earlier action in May 2024, when it immobilized $5.2 million in USDT linked to similar phishing scams, according to CryptoNews.

Phishing has long been a thorn in the side of the cryptocurrency industry, with 2024 trends showing its persistence into 2025, as detailed in Help Net Security’s report from February 27, 2025. Against this backdrop, Tether’s proactive steps underscore its role in protecting USDT, the most widely used stablecoin globally, boasting over $110 billion in circulation.

Experts note Tether’s broader strategy involves partnering with 235 law enforcement agencies across 55 jurisdictions, as highlighted in a Tether.io statement dated March 7, 2025. “We’re steadfast in our mission to fight illicit activities and preserve the integrity of the cryptocurrency ecosystem,” the statement reads, referencing a recent $23 million freeze tied to the sanctioned exchange Garantex.

This freeze carries significant weight for the crypto community, prompting an urgent need for users and platforms to bolster defenses against phishing threats. It also signals Tether’s alignment with regulatory pressures, particularly from bodies like the U.S. Office of Foreign Assets Control, to curb money laundering and terrorist financing.

In short, the latest developments confirm Tether’s freeze of $11 million in USDT as a key response to phishing-related fraud. The takeaway is clear: as more details surface, tech-savvy crypto enthusiasts should keep a close eye on evolving security measures to stay ahead in this fast-moving field.

Join our Telegram Channel

Join our Telegram Channel