Toncoin trades at $2.91 amid mixed market sentiment as key resistance levels and accumulation patterns create setup for potential rally

Toncoin (TON), the native cryptocurrency of The Open Network blockchain, is currently navigating critical technical levels as market participants debate whether the digital asset can break out of its recent consolidation phase. Trading at $2.91 as of July 6, 2025, TON finds itself at a crucial juncture with analyst predictions ranging from bearish short-term corrections to bullish medium-term breakouts of up to 40%.

Current Market Dynamics and Price Action

The Toncoin market is displaying signs of both consolidation and potential momentum building. According to real-time data from major exchanges, TON is currently trading between $2.73-$2.97 across different platforms, with a 24-hour trading volume exceeding $396 million CoinMarketCap.

Recent price action has been characterized by volatility, with the token experiencing both sharp pullbacks and quick recoveries. @cas_abbe, a prominent crypto analyst on X (formerly Twitter), recently highlighted TON’s strong bullish momentum, noting the formation of a clear short-term uptrend pattern supported by significant trading volume Blockchain.news.

Technical Analysis: Key Levels and Patterns

The technical landscape for Toncoin presents a mixed but increasingly interesting picture:

Support and Resistance Levels:

- Key Support: $2.83 (historically strong accumulation zone)

- Immediate Resistance: $3.00 (psychological level)

- Major Resistance: $3.39, $3.60, and $3.90

Moving Averages Signal Caution:

- 50-Day SMA: $3.03 (price currently below)

- 200-Day SMA: $3.76 (significant resistance above)

- Current RSI: 38.68 (neutral territory)

According to technical analysis from CoinCodex, the current sentiment is bearish with a Fear & Greed Index reading of 66 (Greed). The platform notes that TON has recorded 15/30 (50%) green days with 5.21% price volatility over the last 30 days.

Whale Accumulation Patterns Drive Optimistic Outlook

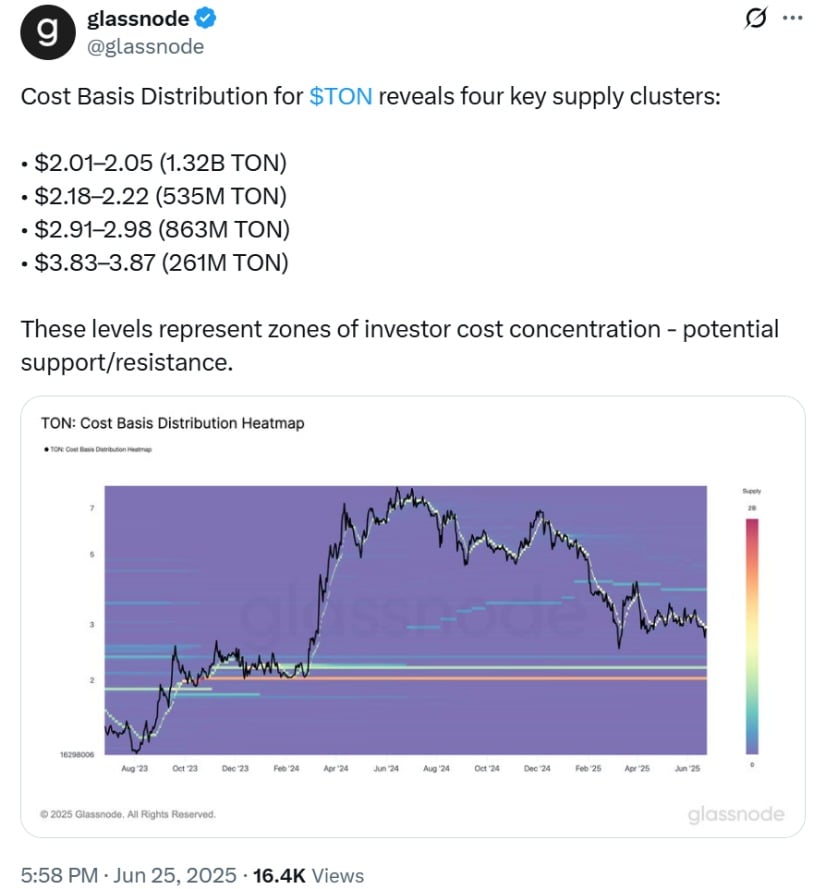

One of the most compelling narratives surrounding Toncoin is the significant whale accumulation activity observed across key price zones. Glassnode data reveals that 2.98 billion TON tokens are concentrated across four significant price zones between $2.00 and $4.00.

Most notably, 863 million TON are held in the $2.91 to $2.98 range by what appears to be a single long-term entity. This level of whale accumulation often signals strong confidence in future price appreciation and provides a solid foundation for potential upward moves Brave New Coin.

Analyst Predictions: 40% Breakout Potential

Several prominent analysts are pointing to a potential 40% price surge if TON can break above the psychological $3.00 resistance level. The bullish thesis is supported by multiple factors:

1. Telegram Integration and Ecosystem Growth

TON’s deep integration with Telegram continues to be a major growth driver, with the platform focusing on increasing Total Value Locked (TVL) in decentralized applications and expanding crypto usage among Telegram’s vast user base.

2. Technical Pattern Formation

Analysts have identified a falling wedge pattern that could trigger a move toward $6.00 if confirmed. The pattern, combined with MACD and RSI divergences, suggests potential for a fifth-wave rally TradingView Analysis.

3. Volume Confirmation

Recent breakout attempts above $3.00 have been supported by substantial trading volume, including spikes of 1.87 million and 1.54 million units, indicating genuine buying interest rather than low-liquidity anomalies.

Market Sentiment Analysis: Mixed Signals

The current market sentiment for Toncoin presents a complex picture with conflicting indicators:

Bullish Factors:

- Fear & Greed Index at 66 (Greed zone)

- Strong whale accumulation patterns

- Growing Telegram ecosystem integration

- Technical pattern suggesting potential breakout

Bearish Factors:

- Price below key moving averages

- Overall technical sentiment rated as bearish

- Recent 60% decline from all-time high of $8.28

- CoinCodex prediction of -25.05% decline to $2.04

Price Predictions: Short-term vs Long-term Outlook

Short-term Predictions (2025)

- CoinCodex: Bearish outlook with potential drop to $2.04 by August 2025

- Changelly: Bullish range between $3.61-$10.52 for July 2025

- Binance: Conservative estimate of $2.91 average for 2025

Medium-term Outlook (2026-2027)

Most analysts maintain a more optimistic medium-term outlook:

- 2026 Target Range: $2.14 – $7.46 (potential 156% gain)

- 2027 Projections: $2.57 – $4.95 range with $3.52 average

Long-term Vision (2030)

Long-term forecasts remain bullish, with several platforms predicting:

- Potential Range: $5.74 – $11.53 by 2030

- Maximum ROI: Up to 296% from current levels

Social Media Sentiment and Community Analysis

X (Twitter) sentiment around Toncoin has been increasingly active, with several key influencers and analysts sharing their perspectives:

Recent Analyst Commentary:

- @WHALES_CRYPTOt highlighted a falling wedge pattern with potential targets toward $6.00

- Hedge With Crypto predicted “strong bullish momentum” with targets above previous highs

- Multiple crypto forums are discussing the potential for TON to reclaim its top 10 crypto status

The hashtag #TONcoinpriceprediction has gained traction, with discussions focusing on the token’s potential to “explode in 2025” based on both fundamental and technical analysis.

Fundamental Developments Impacting Price

TON Ecosystem Expansion

Recent developments within the TON ecosystem include:

- Grant Program Success: 57 projects supported across GameFi, DeFi, and infrastructure in 2024

- Golden Visa Initiative: New program offering 10-year visas for TON holders

- DeFi Growth: Increasing Total Value Locked across TON-based protocols

Regulatory and Market Context

- MEXC COO Prediction: Tracy Jin predicts TON will become the leading everyday blockchain by 2027

- Telegram Integration: Continued expansion of crypto utilities within the Telegram ecosystem

- Market Position: Currently ranked outside top 10 but with potential for reclaim

Risk Factors and Considerations

Potential Downside Risks

- Technical Breakdown: Failure to hold $2.83 support could lead to further decline

- Market Correlation: Strong correlation with broader crypto market sentiment

- Regulatory Challenges: Potential regulatory pressure on Telegram-associated projects

- Competition: Intense competition in the Layer-1 blockchain space

Upside Catalysts

- Telegram User Growth: Expanding user base driving adoption

- DeFi Ecosystem: Growing TVL and protocol development

- Technical Breakout: Confirmed move above $3.00 resistance

- Institutional Interest: Continued whale accumulation patterns

Conclusion: Cautious Optimism with Clear Levels to Watch

Toncoin presents a fascinating case study in cryptocurrency market dynamics, with technical patterns, fundamental developments, and whale behavior all pointing toward potential significant price movement in the coming months. While short-term predictions remain mixed, the combination of strong accumulation patterns, ecosystem growth, and technical setup suggests that TON could be positioning for a substantial breakout.

Key Levels to Monitor:

- Bullish Scenario: Break above $3.00 with volume could target $3.90-$4.00

- Bearish Scenario: Loss of $2.83 support could see decline toward $2.00

For investors considering exposure to TON, the current levels present both opportunity and risk. The significant whale accumulation around current prices provides some downside protection, while the technical pattern suggests potential for substantial upside if key resistance levels are breached.

As always in cryptocurrency markets, risk management and position sizing remain crucial, particularly given TON’s historical volatility and the mixed nature of current technical indicators.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risk, and past performance does not guarantee future results.

Join our Telegram Channel

Join our Telegram Channel