As of April 9, 2025, Tron (TRX) is trading at approximately $0.23, navigating through a critical consolidation phase that could determine its next major move. The cryptocurrency, currently ranked 8th by market capitalization at $21.8 billion, is showing signs of a potential breakout after forming a significant triangle pattern. Let’s analyze the current price action, market sentiment, and what leading analysts are predicting for TRX.

Current Price Action: Triangle Pattern Formation

TRX has entered a crucial technical formation that experts believe could precede a significant price movement. According to recent analysis from CCN, “TRX still trades within the ascending triangle which is likely another corrective structure” following its peak of $0.45 in December 2024 and subsequent correction to $0.20 in February 2025.

The current triangle pattern suggests the market is coiling for a potential breakout, with key levels to watch:

- Immediate Support: $0.205 (ascending triangle base)

- Primary Breakdown Target: $0.189 (0.786 Fibonacci retracement)

- Critical Resistance: $0.245 (0.618 Fibonacci / triangle top)

- Bearish Invalidation: $0.25 (breakout level)

Technical analyst Nikola Lazic from CCN explains that the most probable outlook is that “the e-wave has already been completed, and TRX is now beginning the downward movement,” although a breakout above $0.25 would invalidate this bearish scenario entirely.

Surging Network Activity Supports Bullish Case

While technical patterns suggest caution, on-chain metrics paint a more optimistic picture. Recent data analysis by Ali Martinez shows a remarkable surge in TRON network activity, with 2.94 million active addresses recorded in early March – a two-month high.

This increased network engagement historically correlates with price appreciation, as more active users typically drive demand for the native token. The TRON blockchain has also been collecting significant fees, with Artemis data showing $1.3 million in fees collected in a 24-hour period, surpassing major networks like Ethereum and Solana.

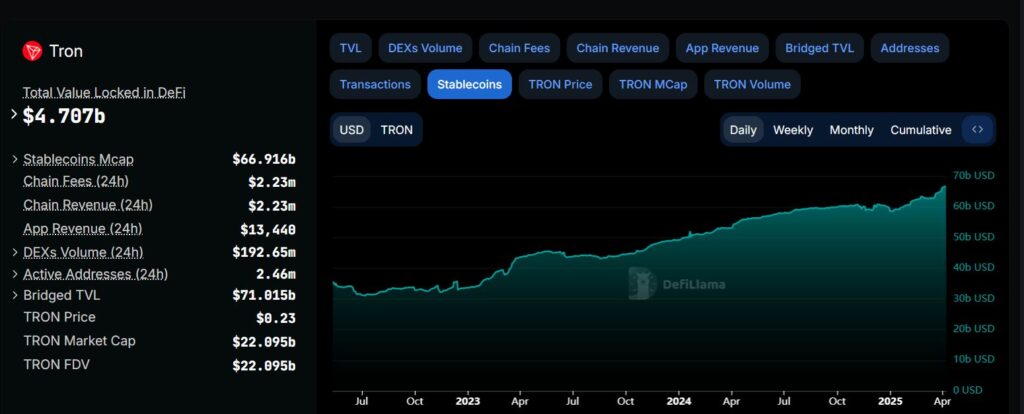

Furthermore, stablecoin activity on the Tron blockchain has shown remarkable growth, with Lookonchain data revealing that stablecoins on Tron increased by $396 million in just a week. According to DefiLlama data, the total stablecoin market capitalization on Tron currently stands at $66.91 billion, showing consistent growth since early January.

X Analysts Set Ambitious Price Targets

Several prominent analysts on X (formerly Twitter) have set bullish targets for TRX, with some projecting a potential rise to $1.

Crypto analyst Crypto Patel recently shared insights on X highlighting TRON’s strong momentum and the possibility of reaching the $1 price target. According to Patel’s analysis, TRX has strong support at $0.140, with the best buy zone between $0.160-$0.180. Notably, Patel had previously predicted a 200-300% surge in TRX price back in October when the token was trading around $0.16, and it subsequently reached $0.426 by December 2024.

$TRX showing strong momentum. $1 price target is potentially achievable. Strong support at $0.140. Best buy zone is $0.160 – $0.180 if we get the opportunity. — Crypto Patel (@CryptoPatel)

Justin Sun, the founder of TRON, has also been active on social media, recently posting “TRON to the SUN” on X, generating excitement among investors and potentially contributing to positive market sentiment.

More ambitious price targets have also emerged, with one top analyst predicting TRX could potentially reach between $1.65 to $2.2 in the future, though timeframes for such targets remain speculative.

Market Sentiment and External Factors

The current Fear and Greed Index for Tron indicates a sentiment reading of “Fear” with a score of 26, suggesting the market may be oversold and potentially presenting buying opportunities. This cautious sentiment aligns with the broader market fluctuations influenced by macroeconomic factors.

Recent developments in the TRON ecosystem could serve as positive catalysts:

- The March 18 announcement that TRX will soon be available on the Solana blockchain

- The growing meme coin ecosystem on TRON, with events like the TRON Meme King Challenge driving community engagement

- The recent integration of TRX with various platforms, expanding its utility

However, external market forces, particularly the recent announcement of additional tariffs by former U.S. President Donald Trump on China, have contributed to broader market volatility affecting cryptocurrencies including TRX.

Long-term Price Projections

Looking beyond immediate price action, several platforms have offered longer-term price predictions for TRX:

- According to Binance’s price prediction, TRX could reach approximately $0.249 by 2026, $0.261 by 2027, and potentially $0.302 by 2030.

- Changelly’s forecast suggests TRX could potentially reach higher levels in the coming years, with some optimistic scenarios putting prices in the $1.93 to $2.35 range by 2033, though such long-term projections should be treated with caution.

While some analysts have speculated about TRX potentially reaching $5 or even $10, these targets appear extremely ambitious and would require extraordinary growth in adoption and market conditions.

Conclusion: What’s Next for TRX?

The current technical setup suggests TRX is at a critical juncture. The break from the triangle pattern, either above $0.25 or below $0.205, will likely determine the short-term direction. The impressive network metrics and growing ecosystem provide fundamental support for bullish scenarios, but investors should remain cautious of broader market volatility.

For traders and investors, monitoring the key support and resistance levels identified by analysts will be crucial in the coming days. Additionally, keeping an eye on Bitcoin‘s price action and overall market sentiment will provide contextual information for TRX’s potential movements.

While the $1 price target mentioned by several analysts represents a significant upside from current levels, such projections should be considered in the context of both technical patterns and fundamental developments in the TRON ecosystem.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Cryptocurrency investments are inherently risky, and investors should conduct their own research before making investment decisions.

Join our Telegram Channel

Join our Telegram Channel