Cryptocurrency Trading and the Golden Cross

In the volatile world of cryptocurrency, traders are constantly seeking reliable indicators to guide investment decisions. One of the most respected tools in technical analysis is the Golden Cross—a bullish signal with a proven track record in both traditional and crypto markets. For traders of Bitcoin, Ethereum, and other digital assets, understanding this signal can offer a competitive edge.

What Is the Golden Cross in Bitcoin and Cryptocurrency?

The Golden Cross is a technical analysis pattern that occurs when a short-term moving average—typically the 50-day—crosses above a long-term moving average like the 200-day. This crossover signals a potential bullish trend and is often interpreted as a strong buy signal.

In charts, the Golden Cross is visually evident as the 50-day moving average line slopes upward and intersects the 200-day line from below. It signifies a shift in momentum and rising investor confidence, especially within fast-moving cryptocurrency markets.

Why the Golden Cross Matters in Bitcoin and Altcoins

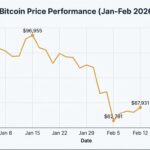

Historically, Bitcoin and other cryptocurrencies have seen significant price surges following a Golden Cross formation. In early 2021, Bitcoin’s Golden Cross foreshadowed a major upward rally, attracting increased investment and pushing market capitalization into new highs.

This pattern is not confined to Bitcoin. Altcoins such as Ethereum and Solana have also demonstrated similar behavior, with prices rallying post-crossover. For serious traders, the Golden Cross serves not just as a chart pattern—but as a signal of changing market psychology.

How to Identify a Golden Cross on TradingView

To spot a Golden Cross on platforms like TradingView, follow these steps:

- Open a crypto chart (e.g., BTC/USD).

- Click on the Indicators tab.

- Add two moving averages: one with a 50-period setting, the other with a 200-period setting.

- Customize colors for clarity.

- Watch for the point where the 50-day line crosses above the 200-day line.

This crossover is your Golden Cross—a potential entry point in cryptocurrency investment.

The Limitations and Risks of the Golden Cross

Despite its popularity, the Golden Cross isn’t foolproof.

- False Signals: In choppy or sideways markets, crossovers can mislead, triggering losses.

- Lagging Nature: Because it’s based on past prices, the signal may appear after a major move.

- Overreliance: Using the Golden Cross in isolation is risky. Always confirm with tools like RSI, MACD, or Fibonacci levels.

Also consider macroeconomic data, institutional moves, and crypto market data—all of which impact price far beyond moving averages.

Best Practices for Using the Golden Cross in Crypto

- Combine with volume analysis and support/resistance levels.

- Integrate on-chain data like wallet activity or miner behavior.

- Use tight stop-losses and practice risk management—especially with volatile altcoins.

- Monitor market sentiment via news, social media, and exchange flows.

Final Thoughts

The Golden Cross remains one of the most influential signals in cryptocurrency trading, especially for assets like Bitcoin and Ethereum. But it must be approached strategically—understood in context, supported by data, and reinforced by complementary indicators.

If you’re serious about navigating the crypto space with insight, the Golden Cross deserves a place in your toolkit. Just remember: in markets driven by volatility, no single tool is a silver bullet.

Join our Telegram Channel

Join our Telegram Channel