XRP, the cryptocurrency linked to Ripple Blockchain, has seen a dramatic surge in retail investor activity over the past six months, triggering warnings from analysts about potential overexposure and an increased risk of market correction.

According to data shared by on-chain analyst CryptoVizArt on X, formerly known as Twitter, more than 70% of the capital currently locked into XRP entered the market near its recent price peak. This pattern, analysts say, mirrors past market cycles and suggests that a reversal could be imminent.

Data from blockchain analytics firm Glassnode shows that the share of XRP’s realized market capitalization held by coins younger than six months jumped from 23% to 62.8% in a short span, highlighting aggressive retail accumulation. This coincided with a 490% increase in network address activity, as noted in Glassnode’s Rippling Away newsletter, published April 3.

“This kind of momentum, driven by FOMO [fear of missing out], is typically unsustainable,” the newsletter stated, suggesting a heightened risk profile for investors who entered during the latest rally.

XRP has long been known for its volatility. The digital asset peaked at $3.84 on Jan. 4, 2018, during the 2017–2018 crypto bull run. More recently, XRP reached approximately $2.50 by mid-2024, according to a Glassnode chart posted on May 24. However, the majority of recent capital entered near that level, leaving many newer investors vulnerable to price swings.

Glassnode’s analysis also points to waning momentum. The report notes a slowdown in profit-taking activity and an uptick in realized losses, suggesting the market may have reached an inflection point. These indicators typically precede broader corrections in crypto assets, analysts say.

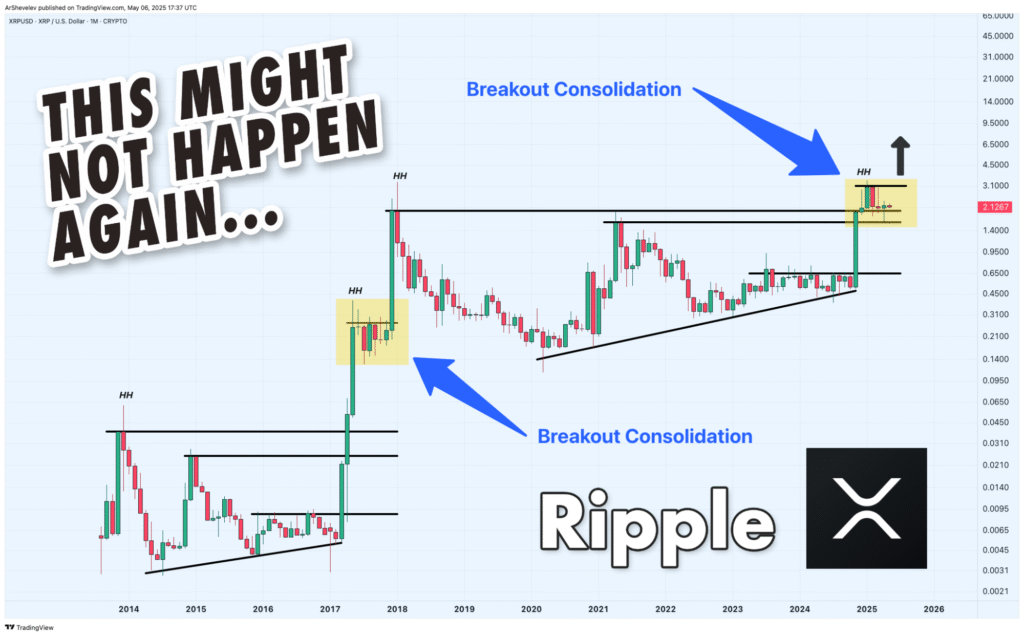

Historical parallels are raising further alarm. In a May 6 Tradingview article, that XRP’s current trajectory closely resembles the asset’s performance in the lead-up to its 2018 high. Analyst ArShevelev speculated that XRP could surge to $10 if it breaks its long-standing resistance at $3.31. However, he warned that failure to breach that level could trigger a steep drop to around $0.65.

Complicating matters, FXStreet reported on Dec. 4, 2024, that a wave of profit-taking followed significant whale activity, with over $4 billion in realized gains. At the time, XRP’s Relative Strength Index signaled overbought conditions, a common precursor to price corrections. Despite retail risk, Ripple investment products drew $95 million in institutional inflows that week—the highest recorded by CoinShares—suggesting a continued divide between retail and institutional sentiment.

Reactions online have reflected a split mood. In response to CryptoVizArt’s post, one user, SHATOSI, lamented in Persian, “Oh man, wasn’t it supposed to hit $33?!” Others responded with memes and ironic commentary, highlighting growing anxiety over XRP’s trajectory.

The concentration of wealth in newly active addresses, coupled with declining momentum, paints a fragile picture for XRP’s near-term prospects. While Ripple continues to promote XRP’s utility in cross-border finance, analysts caution that recent price action is being driven more by speculation than fundamentals.

As the market awaits a clear signal, analysts warn that retail investors could bear the brunt of any correction should momentum continue to fade.

Join our Telegram Channel

Join our Telegram Channel